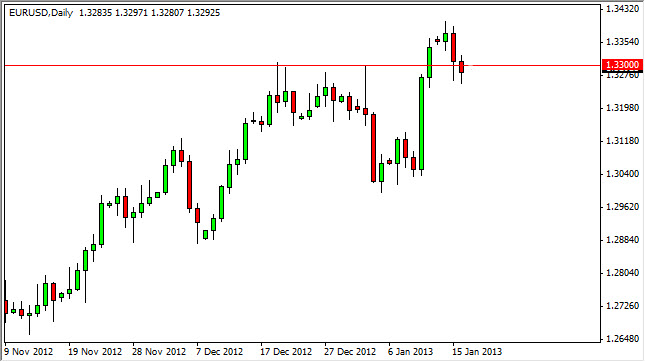

The EUR/USD pair fell during the Wednesday session as the 1.33 level has been retested again. This area was one significant resistance, so it makes sense that we will come back down and try to find out whether the "ceiling becomes the floor." With all that being said, it should be noted that the candle for the day ended up forming a hammer. This hammer of course is a bullish sign, and a break above the top of the hammer of course is a nice buy signal.

We know that the European Central Bank has no interest in cutting its rates right now, so this is a pure interest-rate play to some extent. But it should also be said that the core of Europe seems to be stabilizing a bit and many of the stock indices in Europe are starting to break out to the upside. We have seen this in the CAC 40, DAX, IBEX, MIB, and a few others. With that being said, it makes sense that more money is flowing into Europe, and out of the United States.

Beginning of a massive bull run?

When you look at the longer-term charts, there is a significant level at the 1.35 handle that could determine the future of this pair. If we break above that, we essentially break the neckline of a massive inverted head and shoulders. Ironically, this head and shoulders measures to the 1.5 level, an area that traders to of been around for more than five years will know very well.

With all this being said, we still have to get above the 1.35 level but I do believe that it's coming. I can give you 1 million reasons not to invest in Europe, but unfortunately it seems like there is 1,000,001 not to be involved in the United States. With this being said, it looks as if the buyers and perma-bulls of the Euro are about to have their way with the markets again. Remember, it's not a matter of which he thinks correct, it's a matter been aligned with the attitude of the market.