The EUR/USD pair originally skyrocketed during the Wednesday session as Asian traders reacted to the news of a "fiscal cliff" deal coming out of the United States Congress. This produced a major "risk on" rally that was in effect globally in almost all asset classes as the relief of certainty came into play.

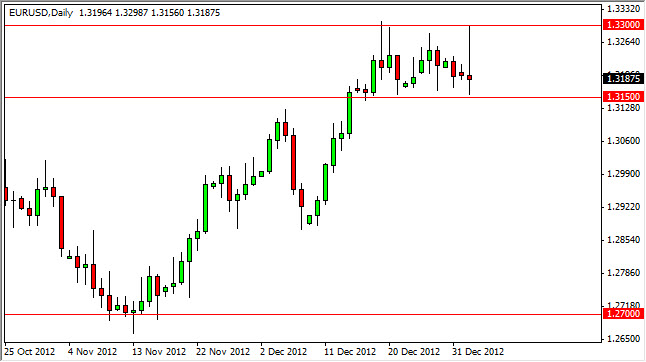

While it is no surprise that the Euro gained on the Dollar in this scenario, when I did find it interesting is the fact that the 1.33 resistance area acted like a break all and simply would not give at all to the buying pressure. What I find it equally as interesting is the fact that we not only fell from there, but fell all the way back down to the 1.3150 level before bouncing slightly to form a massive shooting star.

Odd price action

The fact that the price action was so odd should be sending off alarm bells in your mind. This is interesting mainly because of flies in the face of conventional wisdom, as the pair tends to gain with the "risk on" rallies. What also has caught my attention is the fact that the Euro had a very similar price action against many other currencies around the world on Wednesday. When you have one chart showing this type of price action, it's easy to write it off as an anomaly. However, when you see the same action against various currencies, to me is a massive signal that the market is essentially screaming at you.

Looking at this chart is most obvious that we are in a bullish market currently. However, I do see the 1.3150 level as the beginning of significant support. The 1.31 handle just below would be where I would be looking for the sellers to break through in order to start selling. In an environment like this, we could see a move down to the 1.29 handle in relatively short order.

Some of this action could be due to the fact that we are already starting to see members of Congress bicker about the upcoming debt ceiling negotiations. Quite frankly, this solution that we saw come out of DC was the very minimum that they could have done in order to kick the can down the road so to speak. The debt ceiling debate is expected to start sometime in late February, meaning that we will see continued volatility in the markets.