By: Jonathan Miller

Buy the rumor; sell the news. This age-old mantra has been a mainstay of traders using momentum strategies and more recently adapted as a “headline-screening” algorithm truism. Yesterday’s price action in EURUSD was no different. Initial exit polls showing a possible Bersani win in the Italian elections sent the Euro soaring on confidence that policy would remain unchanged, yet the worst possible election outcome came true with a “hung” parliament. The sudden shift in risk sentiment sent bulls scrambling and a broad-based sell-off with fixed-income markets specifically feeling the immediate pinch.

The Euro was under pressure before the announcement as GDP figures continued to worsen for the economic bloc and political divisions deepen the crisis. The LTRO repayment figures concurrently disappointed markets as actual bank remittance fell sharply to €61.1 billion, approximately half the average analyst estimates of €122.5 billion.

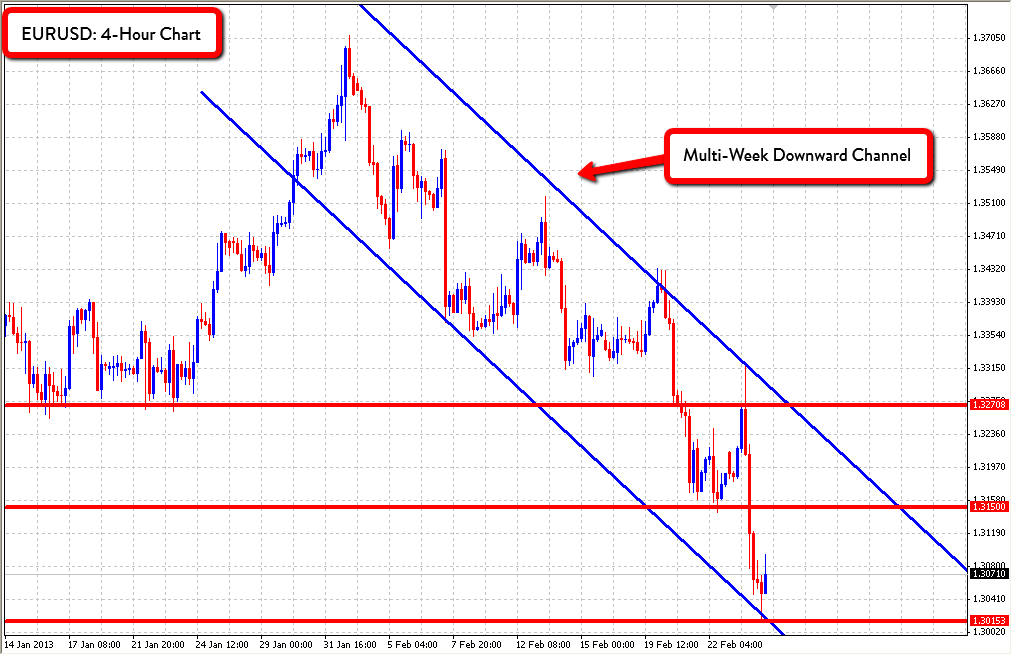

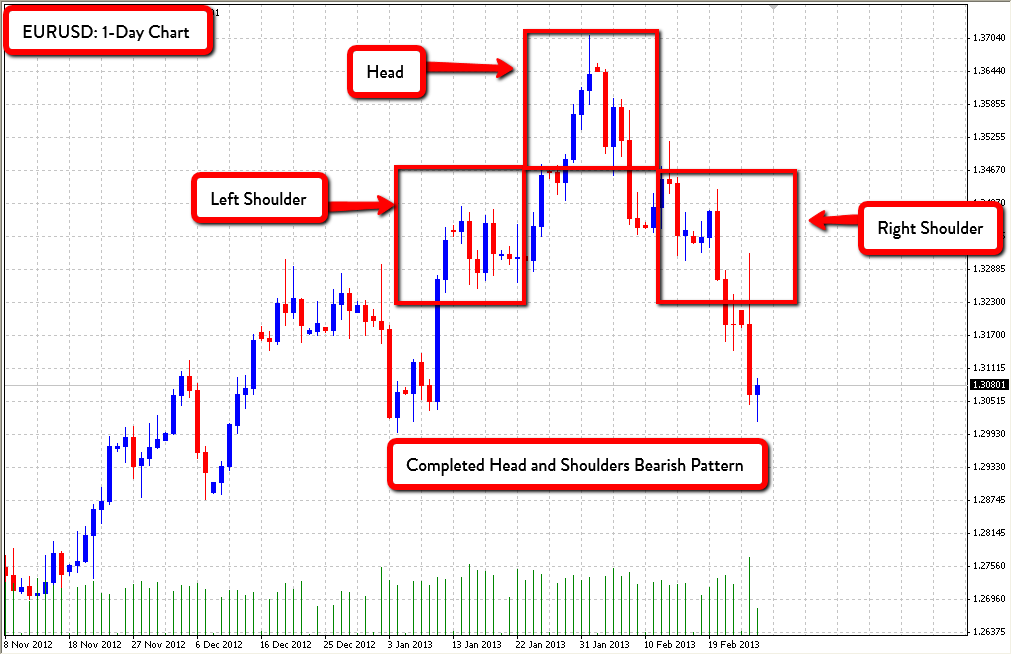

On the technical side, EURUSD was seeing the completion of a multi-week head and shoulders bearish pattern (1-Day Chart) starting from January 10th. With the pattern fulfilled, the currency pair remains at a pivotal turning point, trading near the bottom of a medium-term channel (4-Hour Chart) as the possibility of further weakness remains. The situation in the Eurozone has broadly deteriorated from both a macroeconomic viewpoint and political perspective which could weigh further on already weak fundamentals.

The key support remains at 1.3015 and the 1.3000 handle in the short-term while a break below could see subsequent downside support at the 1.2875 level. An upside surprise would likely see resistance forming at 1.3150 and 1.3270 with the medium-term level sitting higher at 1.3320.