The AUD/USD pair fell during the Friday session as money poured back into the United States. This was a result of a strong jobs number, not a "risk off" trade. As a result, I feel that this market may be changing an important dynamic: That the Australian dollar is no longer a "risk on" currency at the moment, but rather a proxy for Asia.

While that has always been true to a point, it should be noted that stock markets are climbing rapidly while the Australian dollar suffers. This may be because of the ties to Asia, and the fact that perhaps the pricing of Asian growth is a bit overextended. If that's the case, then the Australian dollar will have to come down in value.

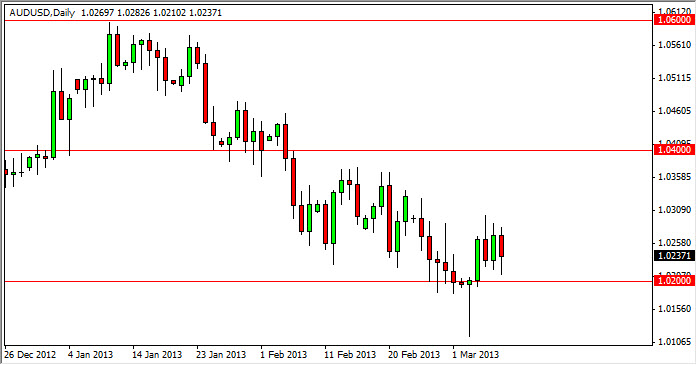

However, I do recognize that the 1.02 level is significant support, as seen by the perfectly shaped hammer from Monday. Remember, we managed to drive all the way down to the 1.01 level before bouncing back relatively quickly and forming a nice looking hammer. Because of this, I feel that this market will put up a serious fight, and as a result could be difficult to sell at this point.

Bottoming?

The one thing that we will have to watch out for in this market is the fact that it does look like it's trying to form some type of bottom at 1.02 or so. The last several sessions have seen this market try to break down below that number, but simply failed. Because of this, I think that it is worth taking a long position on a resistive candle, simply because the risk to reward ratio is so good. After all, if we managed to break the bottom of the hammer from Monday, it would be a very bearish sign, and this would be a clear change in momentum for the longer-term in my opinion. Because of this, I feel that the long position could be recovered rather quickly, as is the advantage of trading at larger areas of importance like we find the pair in at the moment.

The pair has been consolidating for some time between 1.02 and 1.06, and now we get to see whether or not that will continue to be the case…