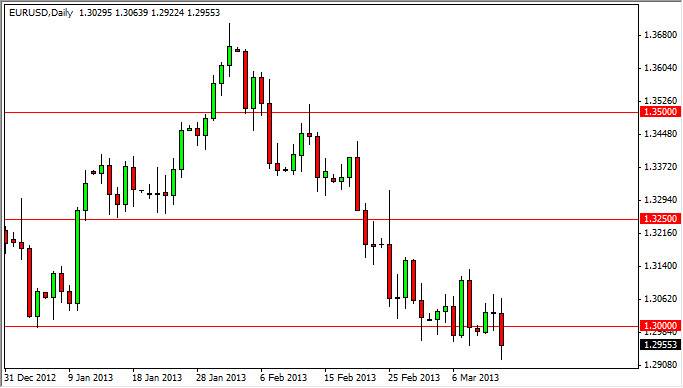

The EUR/USD pair did fall during the Wednesday session, continuing the general bearish attitude of the markets. This doesn't surprise me, I still believe that the Euro could fall farther, but we are certainly sitting on top of what can be best described as a "noisy area", down to the 1.28 level. Because of this, this market is not one of my favorite right now, as I believe we are getting ready to see a lot of sideways action.

Unfortunately, it's difficult to be long of the market as well. It really isn’t until we get above the 1.3250 level that I feel comfortable buying this market. With that being said, I think that this will be more or less a short-term trader’s type of market, and as I tend to be more of a swing trader, that of course causes an issue.

Italian elections

On Friday, the Italian Parliament will supposedly try to come together in some type of coalition. This won't work more than likely, and as a result the markets will be disappointed again. This of course will continue to weigh upon the Euro, and I believe that the common currency will continue to depreciate against most major currencies. And that's the point; we don't necessarily have to trade against the US dollar. In fact, I believe that most of the short Euro trade that is going to be appealing will be against other currencies.

With that being said, I do believe that we will eventually tried to reach the 1.28 handle, but I have a hard time believing that the markets are going to be shocked by the Italians not been able to put it together on Friday. This will lead to a new election, which could cause more uncertainty, but this is going to be like everything else to do with the European crisis, and never-ending saga. (Or at least is going to feel like that.) With that being said, if the Italians do come together with some type of moderate coalition on Friday, there will certainly be an upside risk. Again though, don't hold your breath. I believe we are running sideways with a downward bias over the course of the next several weeks.