By: Johnathan Miller

With limited news out from the Eurozone, EURUSD trades have ground to a near halt as traders pare bets ahead of Central Bank decisions. The major risk factors facing the EU remain unresolved as Italian politics throw the region into further turmoil. Even with the more accommodative comments towards austerity and budgets from the EU leadership, the Euro is lingering in uncertainty following a day of trending sideways. Even with the rally higher this morning, on a longer-term basis, the directional movement of Euro remains at a pivotal point. The endless grind of algorithms moving EURUSD up and down 10 pips makes for unexciting trading and a limited edge as the impetus for movement is nonexistent.

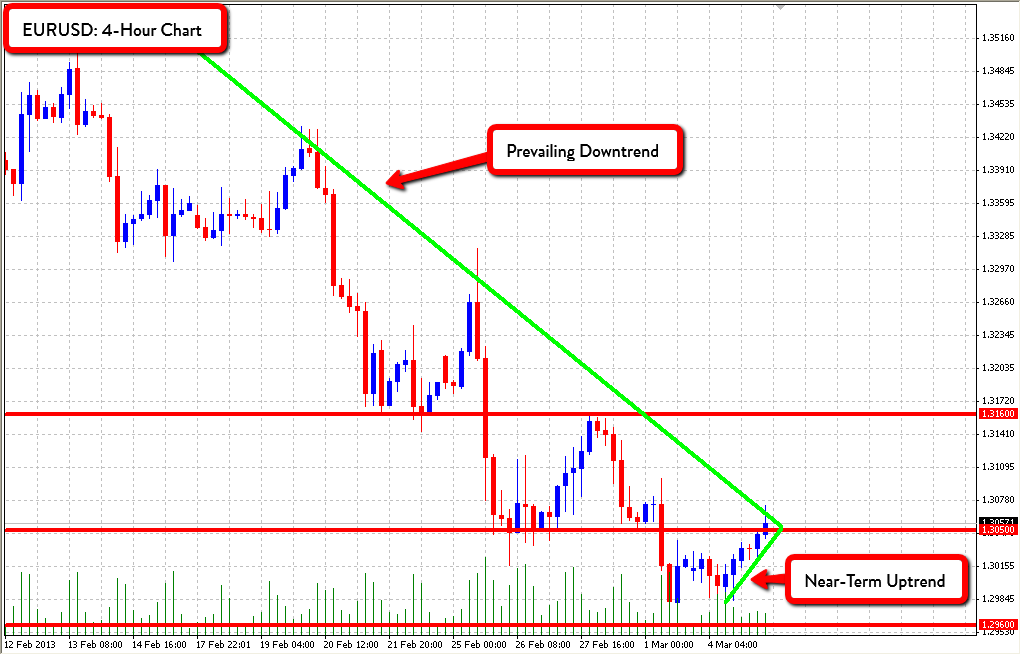

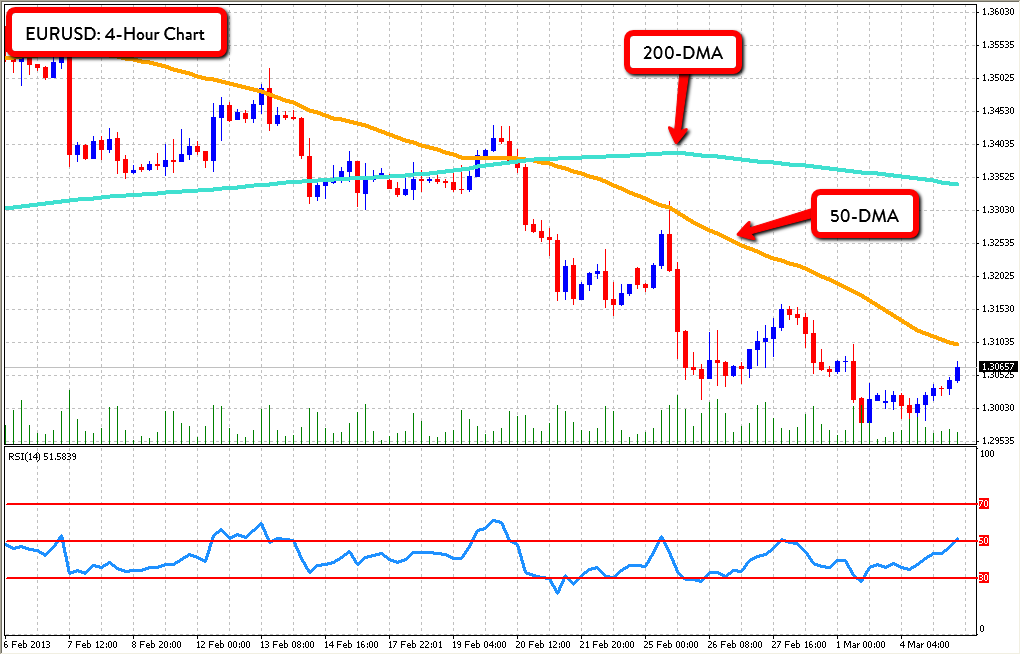

From a technical perspective, EURUSD has recovered from losses during yesterday’s session and continued to trend higher following better than expected PMI data from around the Eurozone. The 4-hour chart shows that the 50-day moving average remains firmly below the 200-day moving average. The RSI remains in “no man’s land” just marginally above the 50 threshold. The key pivot point sits right at 1.3050 while on the upside, resistance lies at 1.3160. Support below the 1.3000 handle rests at 1.2965 (near Friday’s lows) and 1.2850 on a more medium term basis. While longer-term in a prevailing downtrend, near-term corrections in EURUSD are possible considering the swiftness of the move to the downside over the last month.