The USD/CAD pair fell during the session on Monday, as word got out about the details in the Cypriot bank bailout package. The fact that so many people were going to have to take a hit in order to bailout the banks rattled the markets, as the "red line" of forcing senior bondholders to take massive haircuts has now been crossed.

Because of that, you can see that we had a little bit of a "safety bid" in the United States dollar. With that being the case, this pair of course rose in value after initially dipping. It should be noted that the oil markets did in fact rally in a very strong manner originally during the session, but gave back roughly half of their gains in both the Brent and more importantly Light Sweet Crude markets. The Canadian dollar is highly correlated to the Light Sweet Crude markets, as it exports so much of that to the United States.

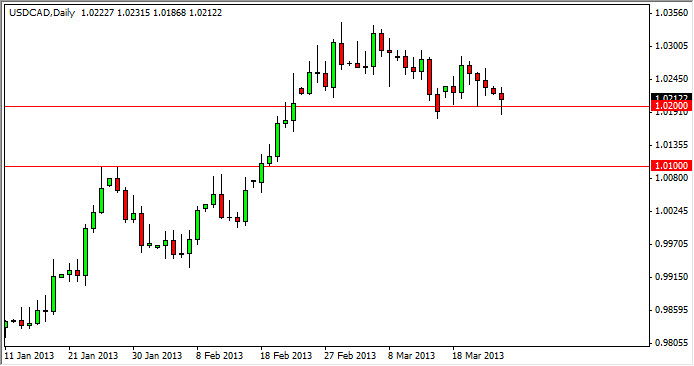

The shape of the candle is a classic hammer, and it of course is based upon the 1.02 level. This level is a minor support level, but it does go with the overall trend of the breakout at the 1.01 handle. Quite frankly, I would be more comfortable buying closer to 1.01 on a sign of support, but it's very possible that we are not getting get that low.

Hammer time

A break of the high from the Monday hammer, I wouldn't hesitate to start buying. Quite frankly, the real struggle is going to be open the 1.04 level, and as a result we should have the opportunity to place a relatively decent short-term trade.

Alternately, we managed to break down below the bottom of a hammer; I do not look at this as a signal to start selling. Rather than that, I would be much more comfortable simply letting the market "come to me" at the 1.01 handle, as for buying their on signs of support. I have no intention of selling this market until we close well below the 1.01 handle, as it would show a real breakdown of support.