The USD/JPY pair had a back and forth session on Tuesday as the markets dealt with the drama in Cyprus. As his pair tends to be a "risk on, risk off" currency pair, it makes sense that even in a small country like Cyprus; you could see reasons for this market to move around. However, there are many other things at play in this market, so it's difficult to measure exactly how much of a difference that political theater had in this market.

As you all know by now, the Bank of Japan is working against the value the Yen, and as a result, we should see continued appreciation of this market. On top of that, the 10 year yield in US treasuries has gained slightly, and this pair tends to track the difference between the American and Japanese 10 year bonds. As it is starting to favor the Americans even more, it makes sense of this pair would rise.

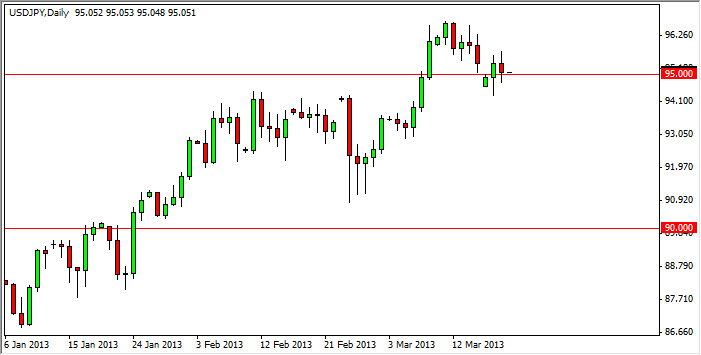

Officials in Japan have suggested over the last couple of days that the fair value of this currency pair is between 95 and 100, and because of this we should see the 95 level offer quite a bit of support. Certainly, from a technical point of view I see that the support runs all the way down to the 94.5 level, and as a result I am a buyer at this point.

Long-term commitment

For myself, I have a long-term commitment to buying this pair. I believe that the Federal Reserve will be painted into a corner, and that the interest rates in the United States will continue to rise over time. I also believe that the Bank of Japan will go absolutely nuclear with their destruction of the Yen if they need to. With that in mind, it's hard to imagine a scenario where this pair falls for any length of time. As a result, I will be buying this pair every time it pullback for the next couple of years. I also believe that we will see the 100 level head sometime in the year 2013, and as a result I think even short-term traders will find value in short-term pullbacks.