The USD/JPY pair so bearish pressure on Friday, as the concerns of a Cypress below of continued. As a result, there was a bit of a "risk off trade” in some currencies, and of course the Yen was purchased because of its well-known safe haven status.

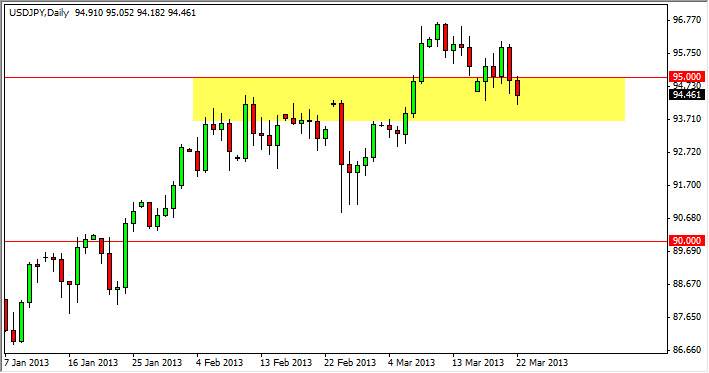

However, as you can see we broke down below the 95 handle but still remained above the support area. After all this is more of a thick "zone" that goes down to roughly the 94 handle. With that being the case, I don't see any reason that this pair should selloff much more, as there should be a ton of noise and support below current levels.

Another thing that this chart or any of the other ones don't show is that the Cypriot Parliament put into effect several laws after the close of the Friday session in order to make it easier to accept the EU bailout package. Because of this, it appears that Cypress will eventually settle to accept the package, and that should take some of the fear out of the market. If the fear comes out of the market, the Yen suddenly becomes a lot less attractive.

Watch the open

It will be interesting to watch how the market opens on Monday, and how the Japanese and other Asian traders react to the news coming out of Nicosia. All things being equal, this pair should start to gain altitude again, especially considering that so many of the traders out there understand that the Bank of Japan is without a doubt going to support this pair specifically.

It has been said recently by members of the Bank of Japan that a trading range of roughly 95 - 100 is what they considered to be fair value, and as a result I have a hard time believing that the market completely ignore that. However, that doesn't mean that this pair will shoot straight up, because I believe that we will see more of grinder at this point as the easy pips have already been made over the last several weeks.