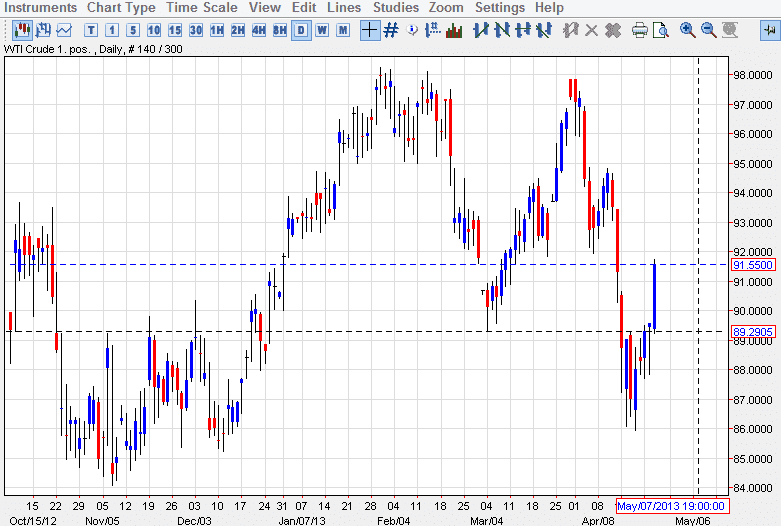

The WTI Crude Oil market rose during the session on Wednesday, reaching the $91.55 level by the end of the session. I have recently mentioned that the $92.00 level would be the beginning of significant resistance, and they do feel that it is a "zone" all the way up to the $92.50 level. This area more than likely will fight off the market, but I have to admit that the candle that we printed for the Wednesday session was indeed fairly strong.

I also have to admit that the fact that the United States announced that the inventory numbers added only half of what was expected, it appears that more crude oil is being burned than suggested previously. This could be a driver for the markets going forward, and as a result of that resistance area just above the $92.00 level doesn't look quite as tough as it did just 24 hours ago.

However, because of this I think I have to wait until the end of the session in order to make some type of decision. I am more than willing to start shorting a very weak looking candle at this point time, but get the sneaking suspicion that this market could breakout at this point. With that being said, I want to see a daily close well above the $92.50 level in order to be comfortable enough to start buying. Alternately, this area looks like a prime candidate to form some type of shooting star candle or something close to it, and as a result that would be a sell signal for me.

The next day or two will be crucial

The next couple of days will be very important as we approach this area. Quite frankly, the market rocketed straight up for the session, so now I have to wonder whether or not we have enough wherewithal to breakout. Many times, when you see a sudden surge like this there isn't enough behind to breakout right away. However, as I suggested previously, this is the type of market with choppiness and all that you would like to see a daily close in order to at least get some type of confirmation before risking any capital at this point.