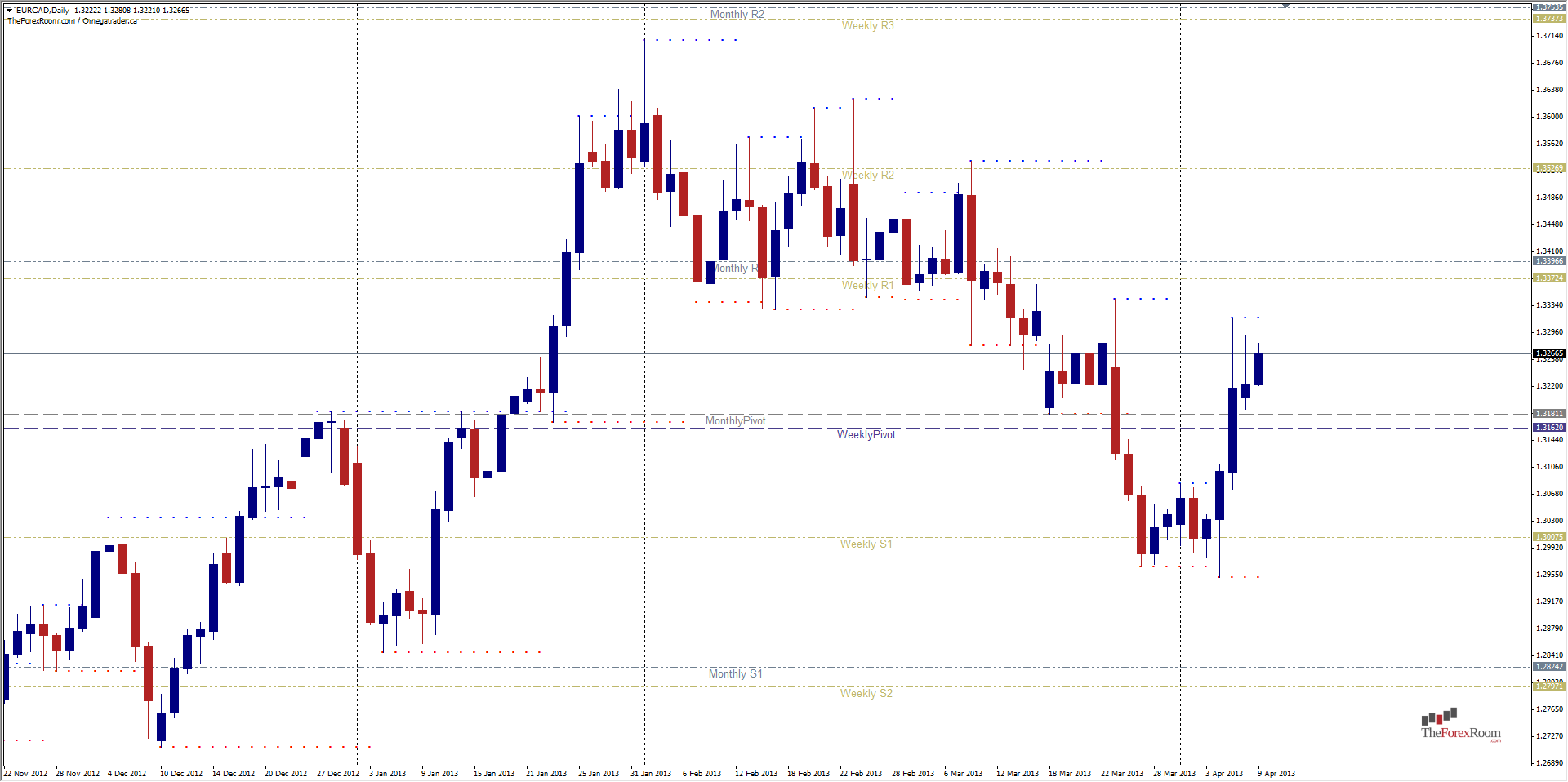

The EUR/CAD, along with many other EUR crosses has formed an inside bar on the daily chart. The pair fell to a low last week of 1.2952 then rebounded in a big way, climbing to a high of 1.3317 before closing on Friday at 1.3218. Yesterday was a light day for fundamentals, and volume across the markets was relatively low which resulted in the formation of an inside bar, a candle that neither made a new high, nor a new low. As the previous days price action was definitely bullish, one could safely assume that a break of 1.3317 could bring on higher prices for this pair. Previous lows at 1.3330 are offering up resistance however, as well as a Weekly R1 and Monthly R1 only about 25 pips apart and covering the job of resistance between 1.3372 & 1.3396 followed by the Weekly R2 and highs from February/March holding back the bulls further at the 1.3530 area. The bears also face support with a monthly & Weekly Pivot separated by only 19 pips at 1.3162 & 1.3181, in addition to the highs from December at 1.3185. A break above the high is more likely, but a break of yesterday's low could also offer buying opportunities if prices bounce again from 1.3185.

EUR/CAD Inside Bar Forms April 9, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address