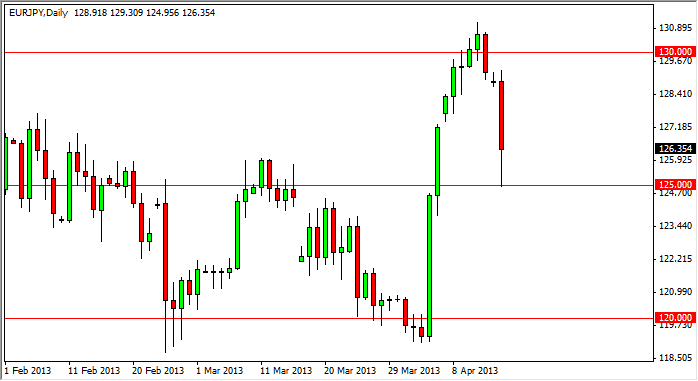

The EUR/JPY pair fell rather precipitously during the session on Monday, as the "risk off" attitude came back into the marketplace. This would have been kicked off by the less than stellar economic numbers out of China overnight, and as a result we saw quite a bit of selling in various marketplaces. With that being said, it wasn't much of surprise of this pair fell.

When you find interesting though is the fact that the 125 level held so strongly. This is an area that I had suspected would be a bit of a "floor" in the marketplace, and it certainly acts as if it's trying to be just that. With that in mind, I think that there is a possibility we may see a bit of bullishness in this market over the next several sessions. In fact, on the four-hour chart I saw a nice hammer based upon the 125 handle, and a move above the top of that hammer might be enough to get people to start jumping into this marketplace again.

Bank of Japan

It's a well-known fact that the Bank of Japan is going to expand its asset purchase program over the next couple of years. With that being said, is very likely that the Yen will continue to weaken against most currencies over the long run, and the massive and brutal selloff that we solve during the Monday session would have been a bit too much. In fact, although I father there could be a pullback as low as the 125 region, I would've never suspected that was going to happen in a few short hours! Because of this, the market has gone from overbought, to oversold in a blink of an eye.

I don't think it will necessarily be the easiest trade to take, and it will certainly be volatile. However, as long as we are over the 125 level I think this market has a real chance to start picking up steam again. It'll be interesting to see how the Asians trade this marketplace, but if they give it a bit of a boost, we could see this market take off again.