EUR/NZD isn't a pair of that a lot of you trade I would suspect. However, it does feature two prominent and major currencies, and the spread is very reasonable - normally somewhere around five pips. However, it is a good currency pair to watch as far as the "risk on" type of trade. This is because the Euro has so much risk with of these days that we will often see it sold off in favor of other "riskier" currencies.

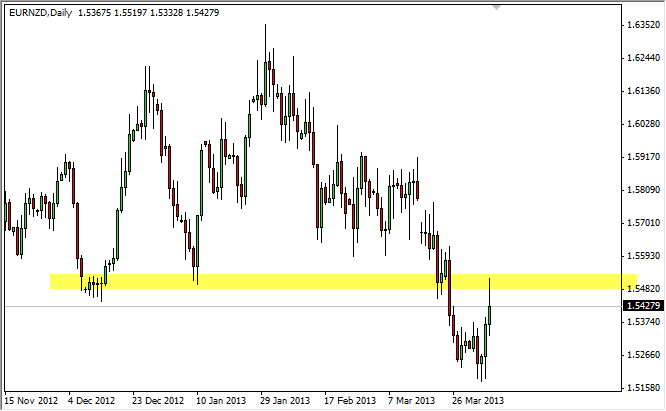

The New Zealand dollar has done quite well over the past week, most notably against the Yen. However, there are signs of waking up against the US dollar as well, so it should be no surprise that the Euro struggle to breakout against the during the Friday session. In fact, if you look at the candle for the day, it is essentially a perfect shooting star right at the 1.55 handle.

It makes sense that we would see resistance in this general vicinity as it was such a stingy support previously, and the fact that it is a large round number. With this in mind, I do believe that this signals we will see Euro weakness, and not just in this market. I believe that the Euro has been overbought over the last couple of days, simply because the central bank failed to state anything particular as far as monetary easing. However, none of the problems in Europe have gone anywhere, and as a result it's only a matter of time before the market starts focusing on them again.

Shooting star at the major handle

The fact that we see a shooting star the 1.55 level is significant in and of itself. The fact that it had been significant support previously of course matters too, and as a result this looks like a nice selling opportunity. I believe that a break of the bottom of the Friday range would have this market selling off and aiming towards the 1.50 level over the course of the next several sessions. Alternately, if we managed to break above the 1.55 level, this would show a tenacity that would be difficult to ignore and have me buying.