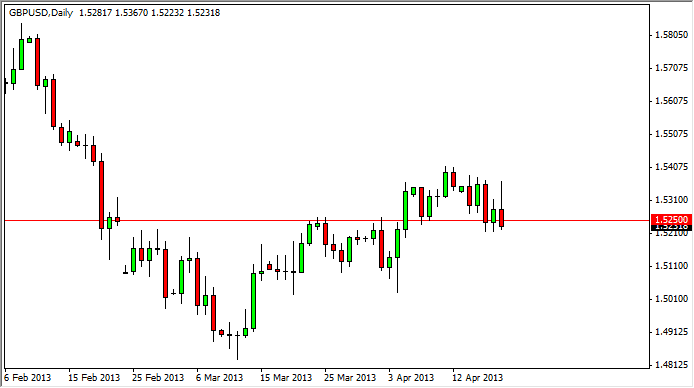

The GBP/USD pair originally tried to rally during the session on Friday, but as you can see gave way towards the end of the session as word got out of a Fitch downgrade of the United Kingdom from "AAA" to "AA+.” What's more important about this chart is the fact that it does not show a reaction from either Europe or Asia. I cannot help but believe that the Europeans and the agent will sell this market off a bit.

On top of that, you can see that we have formed a shooting star and this typically is a very sign. If we managed to break down below the 1.52 level, I believe this market will gradually grind its way down from there. In fact, the pair has been in a downtrend for a significant amount of time, and even before this happened, it looked like it was trying to rollover a bit.

The area that we are currently trading in suggests that we will have to make some type of serious decision here. I truly believe that in the long run, the British pound will start the week again. It is possible that we may have just seen the extent of the rally based upon the news coming out on Friday.

We are still in a downtrend

Even though we had a nice grind higher, and it can be said that we've been in a channel, we are still in an overall downtrend. It is because of this that I would not be surprised to see the downward pressure finally push this market lower. To be honest, I find very few things to make me want to the British pound at the moment, beyond the fact that we did breakout above the 1.5250 level.

With a new Bank of England Gov. coming, there is a possibility that the central bank is simply waiting to have Mr. Carney take over in July before making any significant moves. Nonetheless, the news itself of the downgrade may be treated somewhat cautiously, because Fitch did keep its outlook to "stable." I think this pair will fall, but may not be as drastic as one would expect.