The Mexican Peso isn't one of those pairs that most of you will trade very often, but it really is one you should pay attention to. It's one of the best performing currencies when it comes to trying to track the so-called "emerging markets", and is probably one of the few currencies that most of you can find to trade in Latin America.

The Mexican peso is a currency that has a higher than usual interest rate, so when times are good it tends to do well. However, this pair is highly correlated to the US economy as well. They will do better when times are better in America, as Mexico sends a massive amount of exports into the United States. Also, the Mexican peso is actually a commodity currency. Mexicans drill quite a bit of oil in not only the Gulf of Mexico, but in other places in the region.

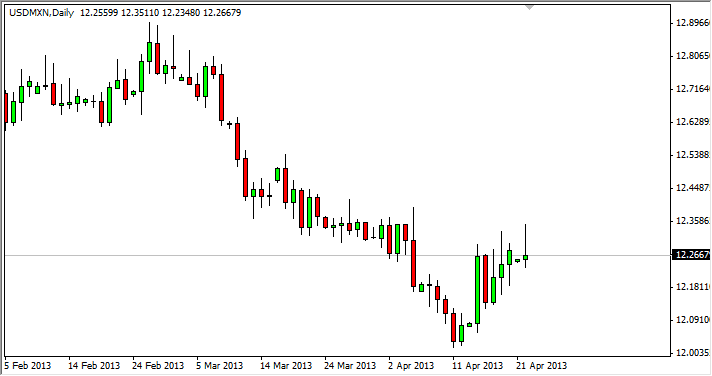

Shooting star

The Mexican peso has been one of the better performing currencies so far in the year 2013. What catches my attention on this chart is the fact that we have formed a shooting star at the 12.2670 area, and it is an area that has previously been supported. This would go with the overall trend, if we can get a break of the bottom of the Monday range. That being said, you should have the full weight of the market behind you if you are shorting this pair.

To get an idea of how strong the Mexican peso has been this year, while the US dollar has been beating most other currencies severely, this pair has been in a downtrend. With that being the case, I feel that this pair will continue lower, and more than likely we will try to target the 12.00 handle again. That isn't asking much, as it is simply returning to the previous lows. Because of this, I fully expect this to happen, but will not be shorting this pair until we break the bottom of the Monday range as it would show a capitulation of support.