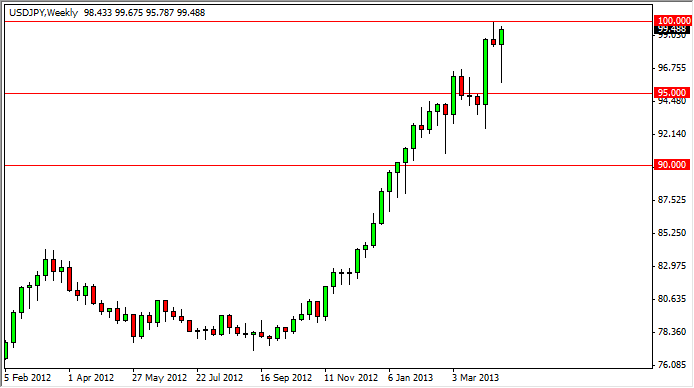

EUR/USD

The EUR/USD pair had an interesting week, starting out bullish, but yet again failing to truly breakout to the upside. The market originally broke above the 1.31 resistance area, but pulled back in the back half of the week. The candle is placed exactly where the resistance has shown up time and time again, and because of this I think this pair will breakdown soon. However, I am not looking at the pair as a potential meltdown waiting to happen, but rather looking to consolidate between the 1.31 level and 1.2750 or so. I think this choppiness will continue for months, as there are plenty of reasons for the Euro sell off, but the currency seems to have a second life at all times.

GBP/USD

The GBP/USD pair fell this past week, but the most interesting thing didn’t happen until late on Friday. The ratings agency Fitch downgraded the UK, but this was long after the Asians and Europeans left their desks. This means that the market hasn’t fully reacted yet, and as a result I can only assume that we are going to see this pair fall further. The previous candle on the weekly chart was a hammer, and that hammer is now looking to become a “hanging man” as the bottom of the hammer has been broken to the downside. This is one of the most bearish candlesticks out there, and I can’t help but think lower prices are in our future.

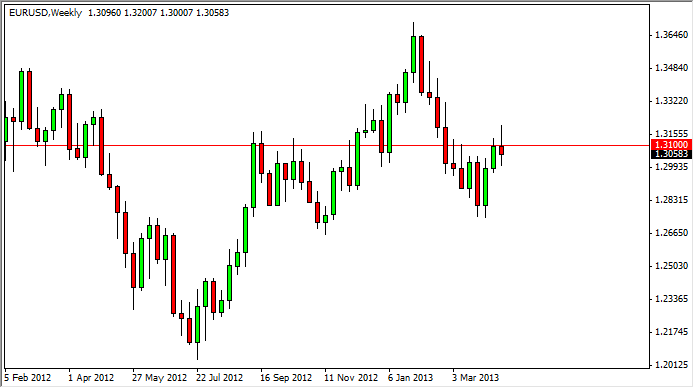

USD/CAD

The USD/CAD pair had a bullish week, breaking through the 1.02 level, and also managed to break the top of the past two hammers on the weekly chart. The market looks like it will take a shot at breaking above the 1.03 level, and possibly the 1.04 level as well. If this level gets broken above, this pair could really take off.

Pay attention to the oil markets, as a selloff in that market will certainly move this pair higher. The Canadian dollar generally follows the value of oil, and as a result this pair could suddenly become very volatile.

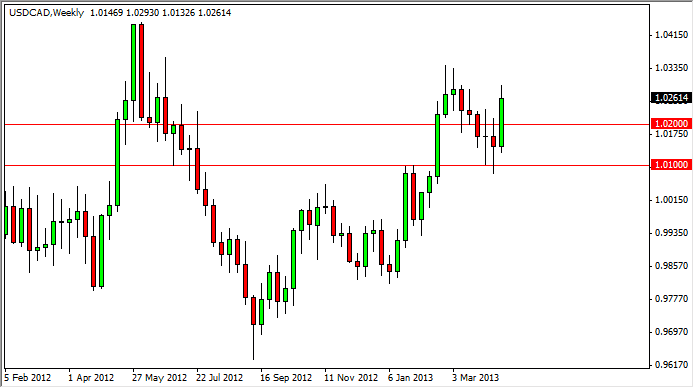

USD/JPY

The USD/JPY pair had a bullish week yet again, but not after falling significantly in the beginning. The pair formed a massive hammer, and now sits just below the 100 handle. The G 20 may have just given the Japanese the “green light” as the statement suggested that the BoJ’s weakening Yen is understandable and necessary, just that the Japanese need to be careful as to not harm other economies.