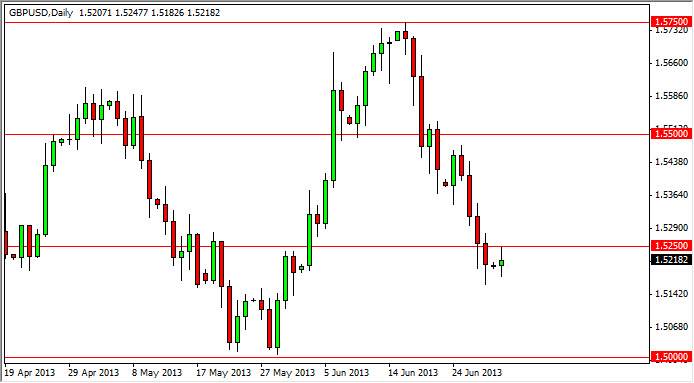

The GBP/USD pair went back and forth during the session on Monday, but as you can see the 1.5250 level has offered enough resistance in order to keep the market down. The fact that we couldn't bounce any stronger than this does tell me that this pair is still under an extraordinarily high amount of pressure to the downside, and that being the case should continue the bearishness going forward.

However, we could possibly break higher and above the 1.5250 level, and if we do, we would more than likely see a lot of resistance once we got closer to the 1.54 area. That being the case, I feel that selling this market is going to be the only way to go, as the British economy is definitely on the back foot. There is also the possibility of new Bank of England Gov. Carney pushing for more quantitative easing, which of course should weaken the value of the Pound.

The Federal Reserve

With the Federal Reserve looking to pull out of quantitative easing mode, this should be the "double whammy" for this pair. We should continue lower, and a break of the lows from Friday should see this pair reach for the 1.50 level. The 1.50 level however is going to be much more significant in its support, and as a result I would be leery of trying to hold a short below that level. However, if we do close below that level, look out below!

I have no interest in selling the Dollar at the moment, and the Pound certainly wouldn't be the currency to change my mind. Needless to say, with the new Gov. Carney taken over at the Bank of England, it's more than likely going to be a pair that's driven on headlines and sound bites, which of course will be very difficult to deal with at times. Short-term trading is probably going to be the norm, and as a result I might focus more on the four-hour chart than anything else. The weekly chart looks a bit confused at the moment, although the latest selloff has been rather drastic, and as a result a little bit of a bounce from here wouldn't surprise me overall.