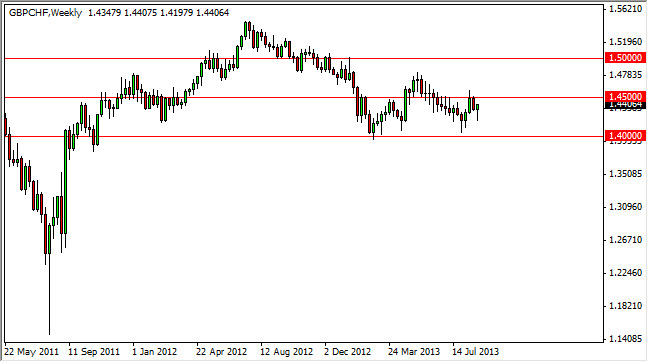

The GBP/CHF pair has been very sideways for some time now. However, many of you probably don't remember a time when this was a "risk on” type of currency pair. This used to be one of my favorite pairs to trade it when the markets were in a generally happy mood, because it would move so quickly. We haven't seen that type of action in some time, but it does appear that the market has found a "floor" in this market, as the 1.40 handle.

It is because of this that I am featuring this pair. I believe that we will continue the consolidation between the 1.40 and 1.50 areas, with an upward bias. The 1.45 level was what I would essentially assume to be "fair value", and as a result I would expect this pair to go back and forth in that general area, but it is now apparent that every time this pair gets down towards the 1.40 handle, there are buyers to step in and pick this up.

British pound

The British pound in general has been doing fairly well. Because of this, I believe that this pair will have an upward bias, although I don't necessarily expect to see the 1.50 level broken during the month of September. With that in mind, I am only buying this pair when it gets, because I know that the Swiss franc isn't favored at the moment, and the British pound seems to be attracting more and more traders.

However, I do have to admit that if we close below the 1.40 level with any significance at all, this pair could absolutely fall apart, possibly as low as 1.25 before the move is said and done. I don't anticipate that happening, simply because it has been so supportive, and as a result I am willing to buy way this pair down towards the 1.40 level without any particular type of price action simply because it has been so strong. If we can get above the 1.50 level, we will be heading to the 1.55 handle, but again, I don't think that's going to happen right away. These are relatively short term moves, or maybe two or 300 pips at a time.