The gold markets are without a doubt going to be one of the more difficult market to deal with in the month of September. This is because of the concerns coming out of the Federal Reserve and whether or not they are going to taper off of quantitative easing. This market will have absolutely nothing to do with gold itself, and a whole lot to do with the US dollar.

This is because the Federal Reserve is considering tapering off of quantitative easing in the month of September, and if they do it will have a great effect on the value of the US dollar, which is of course what this contract is priced in. Simply put, a stronger US dollar will mean lower gold prices as it takes less of those Dollars to buy the commodity.

Naturally, if the Federal Reserve does not taper off of quantitative easing the markets will punish the US dollar, and that means that gold will skyrocket. It is because of this situation that it's almost impossible to make a clear and concise analysis until we know what the Federal Reserve does. However, there are certain levels that we could watch that will give us clues as to the next move in this market.

Levels

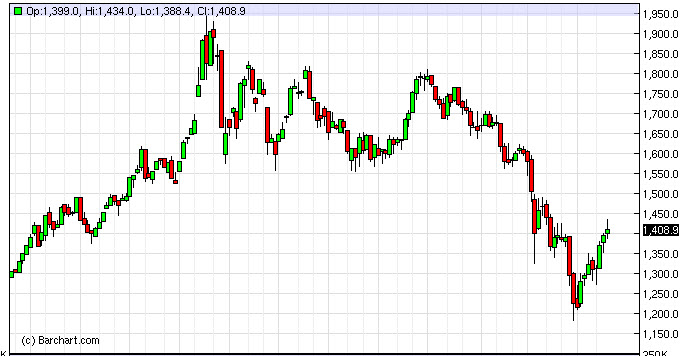

The $1500 level is absolutely crucial for the sellers to hold onto. If the market gets above that on a daily close, I believe that we will eventually hit $1800, slicing through the consolidation zone that starts at $1600 without too many issues. This is because a move like that would almost certainly needed to see massive momentum, which in my opinion will be caused by the Federal Reserve not tapering.

However, as I write this article we are starting to see the market try to pull back a little bit. If we can get below $1350, I think that this market could fall apart. If the Federal Reserve does in fact decide to taper during the month of September, as soon as that announcement comes out, gold will plummet - so will most commodities for that matter.