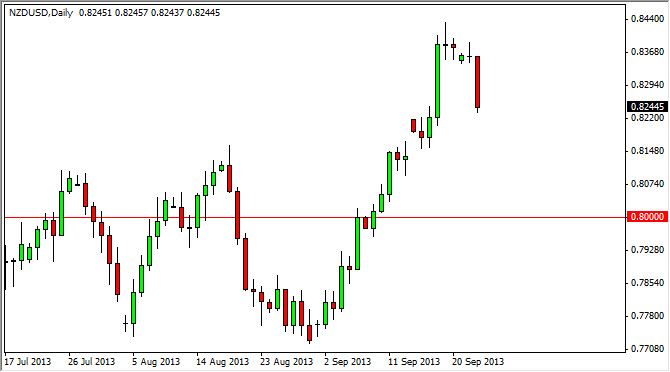

The NZD/USD pair fell hard during the session on Tuesday, breaking down below the 0.8250 level towards the end of the day. The "risk off" attitude of market participants of course have the New Zealand dollar selling off, but as you can see the market has been very positive and parabolic over the last several weeks, so it makes perfect sense the market ran out of steam at this point in time.

Nonetheless, we still are bullish of the New Zealand dollar simply because it had such a positive move. Granted, this is a very ugly candle for the Tuesday session, but when looked at in the prism of the last several weeks, there really isn't much to say about this candle rather than it is a potential buying opportunity at this point.

0.82 still matters

I still believe that the 0.82 level still matters to this market, and as a result we will see a little bit of a reaction down there and potential support to push this market back up. I would love to see some type of supportive candle down in that general vicinity as it would represent a previous breakout, and then retest of that resistance as support - which of course is a classic tenet of technical analysis.

I also believe that the Federal Reserve will continue to be front and center on traders’ minds around the world, and that being the case you have to focus on the US dollar positions more than New Zealand dollar. This of course is a market that is very volatile, and especially susceptible to commodity pricing. That being the case, the markets should find supportive action below, and with that being the case we feel that this market is probably going to be one that should offer value fairly soon. I certainly believe this, and recognize the fact that the New Zealand dollar really hasn't reaches full potential in this latest move. I think we’re heading to the 0.85 handle before it's all said and done, and that's why I am looking for supportive candles below in order to take advantage of cheaper prices.