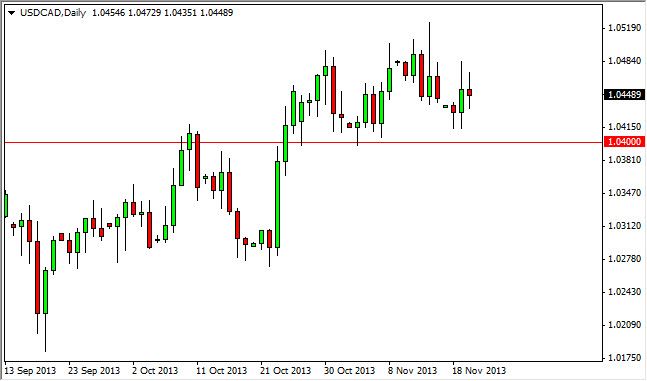

The USD/CAD pair went back and forth during the session on Wednesday, but as you can see is closing the day slightly negative. This market is stuck in a 100 PIP range at the moment, with the 1.04 level on the bottom offering plenty of support, and the 1.05 level on the top offering plenty of resistance. With that being said, pay attention to the oil markets as they have been consolidating as well. This is especially true in the WTI market, which of course is highly correlated with this pair as quite a bit of Light Sweet Crude comes out of Canada. This will drive the value of the Canadian dollar in general, so as that market is stuck, it makes sense that this currency pair is as well.

A move above the 1.05 handle offers the ability to hold onto a trade for a little bit longer-term, and that becomes especially true above the 1.06 handle as it opens the door to the 1.10 level. There is essentially, an "air pocket" between 1.06 and 1.10, so I believe that the market will move between those two levels relatively quickly and I would be willing to pile on a large position for that breakout to the upside.

Plenty of support below.

I believe that there is plenty of support below, especially once you see the 1.04 level as being supportive for the consolidation area that we have been in. Below there, I see plenty of support all the way down to the 1.03 handle, which should have this market looking for buyers in the general vicinity. It really isn't until we break down below the 1.03 handle that I think that selling can be done in this marketplace, so I essentially have forgotten all about it for the time being.

You can also continue to play the range between 1.04 and 1.05 on short term charts as well, but recognize the fact that we will eventually breakout, and in my opinion it will be to the upside.