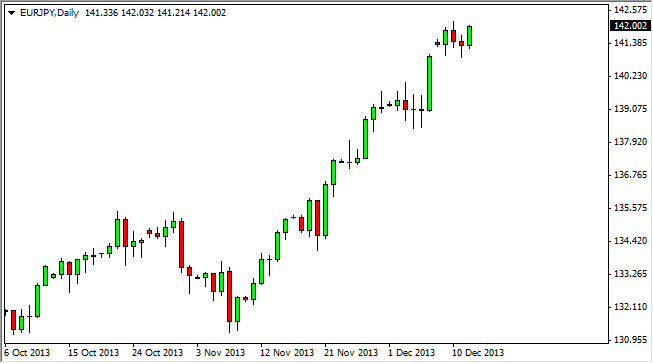

The EUR/JPY pair rose during the session on Thursday, as the "risk on" attitude came back into the marketplace. The Japanese yen continues to get pummeled, and as a result this market hit the 142 handle. The gap that had formed at the open this week continues to offer support, and now I believe that this market is heading to the 145 level. Even if we pullback and find sellers, I believe that any type of supportive action is a buying opportunity as this market looks set to continue this longer-term trend to the upside over the course of the next couple of years in my opinion.

Even if we did fall from here, I believe that the 139 level will be very supportive, and is probably the "floor" in this market. The Japanese yen has struggled against most other currencies, and the Euro seems to be doing fairly well as well. Because of this, this market looks like it is the essential "one-way trade", and as a result I am buying every time it falls back.

145 and beyond.

I believe that we will hit 145 rather quickly, and then much higher levels as we get into the 2014 trading year. After all, the Japanese yen itself is getting beaten up against almost every other currency, and the Euro is doing fairly well against the US dollar, its natural counterpart. With that being the case, I really see no reason why the 150 level will be hit in the next several months.

Worst-case scenario, I think that the 135 level is the absolute bottom of this market. I would be stunned to see this move, but would be willing to pile on the long position if we get a supportive candle. However, when you look at all of the noise at the 139 level, I truly believe that's it as far as the sellers go. Pay attention to the world stock markets, as this pair tends to follow the overall attitude of markets around the world. Pay attention to the Nikkei and the S&P 500 in particular.