The XAU/USD pair fell sharply and give back all of the gains made in the previous session as the American dollar strengthened across the board. Weakening data from China and global growth concerns contributed to gold’s losses as well. Since Chinese gold consumption plays an important role in this market, disappointing numbers out of China puts pressure on prices.

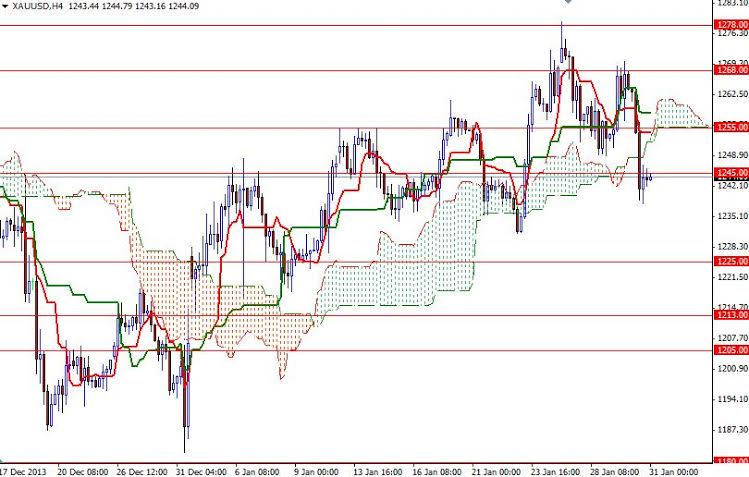

For the last couple of days, I have been telling about the significance of the Ichimoku clouds on the daily chart and I still think the market will go back and forth until we leave this area completely. In order to regain their strength and march towards the 1255 level, the bulls will have to push the pair above 1245. At this point, only a close below the 1255 resistance level would make me think that the market is going to tackle the 1268 level again.

There are many forms of resistance (such as the top of the cloud and Fibonacci 38.2) lining up together in the 1268 - 1278 area, so it will be a tough nut to crack. To the downside, the bears will have to drag the XAU/USD pair below the 1235 level to increase pressure. On the daily chart, the bottom of the Ichimoku cloud currently sits just above the 1225 support level (1227.50) and as you can see the market spent plenty of time around there since December. If this support gives way, I think the 1213 level may be tested soon after.