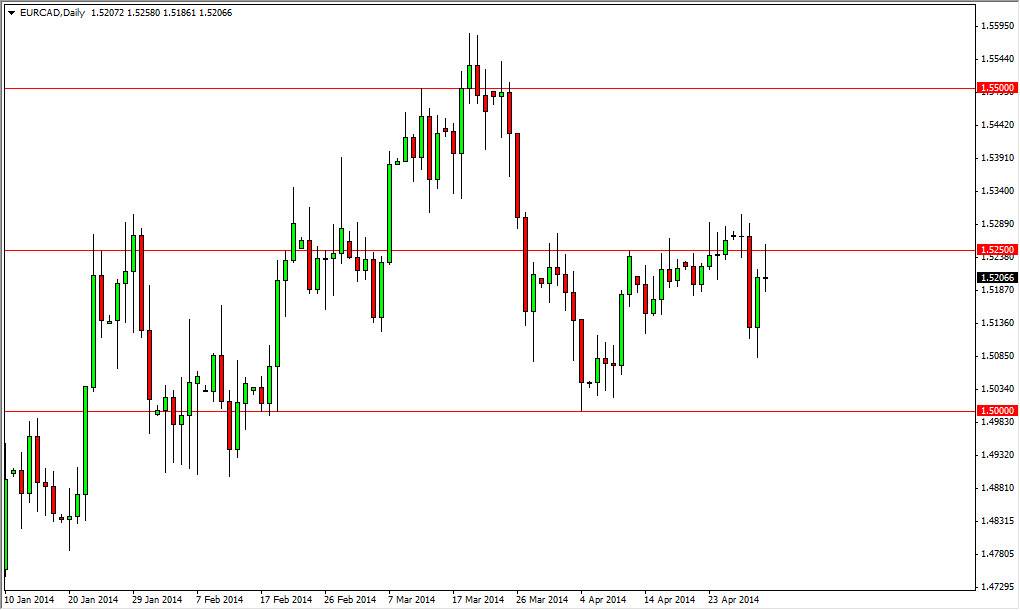

The EUR/CAD pair rose during the session on Thursday, but as you can see found resistance at the 1.5250 level again, in order to pull back and form a shooting star. The shooting star is very similar to what we see in the EUR/USD pair, so I would have to believe that the two markets will move in tandem later today. This is especially true considering that the nonfarm payroll numbers come out, which of course throws a monkey wrench in almost every pair of the Forex market.

If we pull back from here, I still think that there’s a significant amount of support down the 1.50 level, so I don’t think we could sell off to drastically from that. Nonetheless, the Canadian dollar has been a bit soft, so it’s very possible that if the Euro takes off against the US dollar, this might actually be the pair to be involved in. After all, the Canadian dollar has been soft against quite a few other currencies, so if the Euro is doing really well, you might as well pair it with a very weak currency like the Loonie.

Short-term trading.

As far as I can tell, this is a pair that will more than likely feature a lot of short-term trading. Because of this, I feel that this market will be very good for short-term “smash and grab” type of moves. If we breakout to the upside, we would more than likely go to the 1.55 level, given enough time.

That level could be very resistive, so give it a little bit of time to get above there. A pullback in that area more than likely would find buyers looking to jump back into the marketplace, and give us more buying opportunities going forward. On the other hand, if we fell from here I believe that this market will find a bit of support at the 1.51 level, but the 1.50 level will be the target for the sellers. Below there, things get a little bit sketchy as there is a significant amount of support all the way down to the 1.49 level.