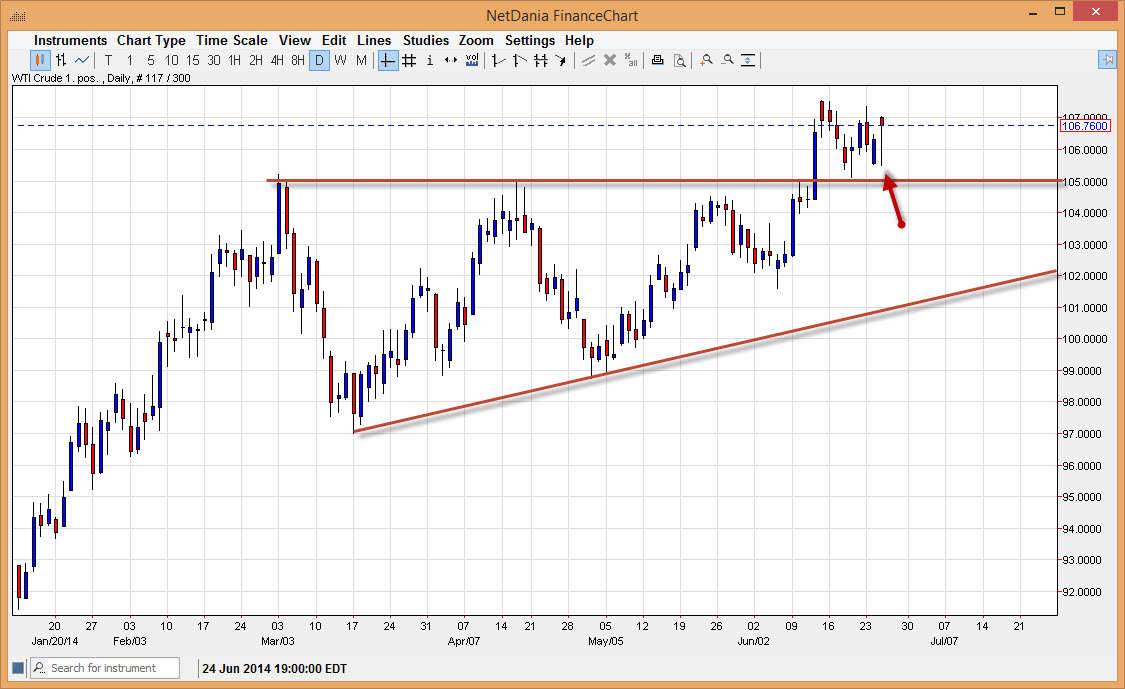

The WTI Crude Oil market initially gapped higher at the open on Wednesday, but spent the rest the day falling backwards, only to turn around at the $105.75 level and form a nice-looking hammer. The hammer suggests that there are buyers in the neighborhood, and as a result I suspect that this market is ready to break out to the upside again. The $107.50 level just above is significant resistance, and as a result a move above that level is in fact a very bullish sign as far as I can see. In fact, I would expect this market to go directly to the $110 level if we can break that area.

Pullbacks in this general vicinity should have plenty of support, especially near the $105 level. With that, the market should continue to find buyers in the lower areas, and with that I would expect the market to continue to look very bullish for the time being. Having said that, it looks like we are ready to go anywhere at the moment, and therefore we are going to grind sideways in the meantime.

Cannot fight the trend.

There is a horrible expression that traders hear when they first start. It is something to do with “not going with the herd.” This is probably the single most stupid thing that someone can tell you. After all, if you are the only person going in one particular direction, you don’t have anybody to push the market in your direction. After all, you aren’t big enough to move it!

With that being the case, I believe that you cannot fight this trend going forward. It’s an obvious uptrend that we are dealing with at the moment, and because of that I suspect that the pullbacks will be looked at as value going forward. And ultimately believe that the market will hit the aforementioned $110 level, and I believe it’s probably going to happen much quicker than most people anticipate. After all, were only one really bad headline out of Iraq away from some pretty impulsive moves in my opinion.