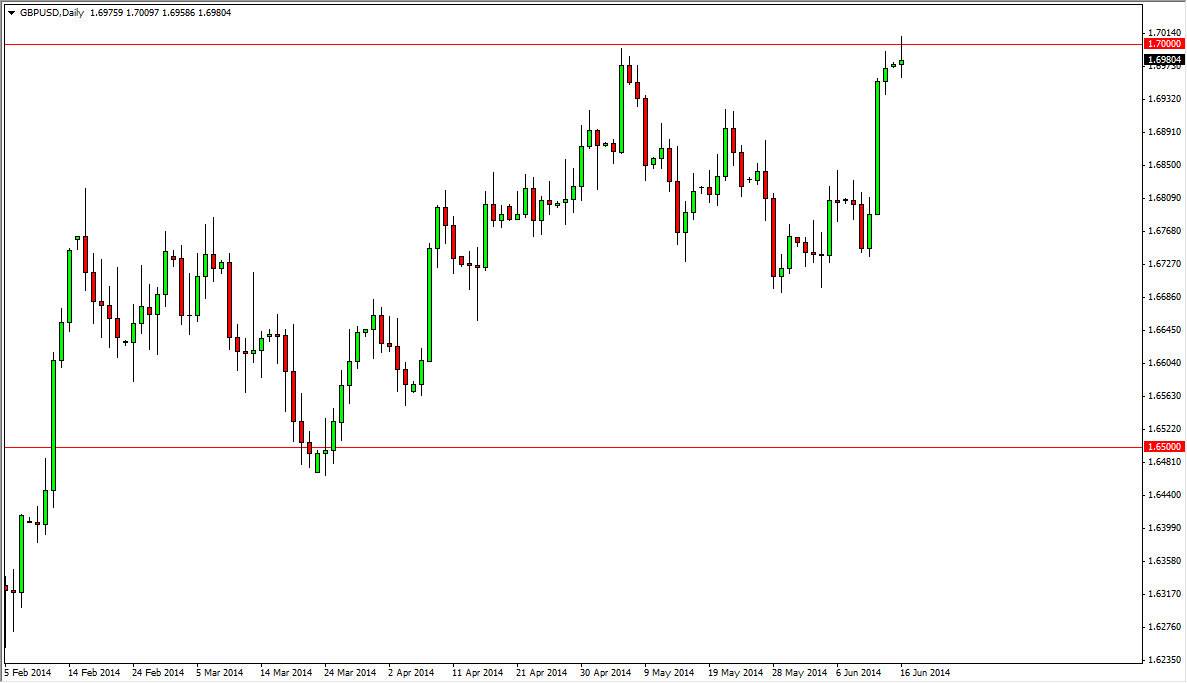

The GBP/USD pair tried to breakout during the session on Monday, but the 1.70 level has offered enough resistance again to keep the market down. The resulting candle of course is a shooting star and I feel that the sellers will probably step in at this point in time. I don’t necessarily think that this is a great selling opportunity, it’s just simply that the market gained far too much in far too short of a time period. Because of this, we are running out of momentum, and the 1.70 level has been massively resistive so it’s not a surprise that we stalled.

Ultimately, I am actually going to be looking for buying opportunities below. A supportive candle below the general area we are in right now is going to be a nice buying opportunity in my opinion, and because of this I feel that simply sitting on the sidelines is probably the safest trade at the moment.

The alternate scenario.

For myself, a break above the top of the shooting star would be a massively bullish sign, and I would be buying up there as well. This will be especially true if we get a daily close above that level, as the 1.70 level should be the signal that we are going to go higher once it’s behind us. If we get above there, we feel that the market goes to the 1.75 level over the course of the longer-term. Remember, now that we are heading into the summer, it could mean slow markets. Getting to the 1.75 level might take some time, so one antidote for that type of trading is to simply buy dips as they appear on short-term charts, using the longer-term charts as your guide.

The British pound in general looks very strong, so I do like going long of it sooner or later. If we got below the 1.67 level, we would probably see the market fall the way down to the 1.65 handle. Down there, I see a massive amount of support that will not let the market fall.