GBP/USD Signal Update

Last Thursday’s signals were not triggered and expired.

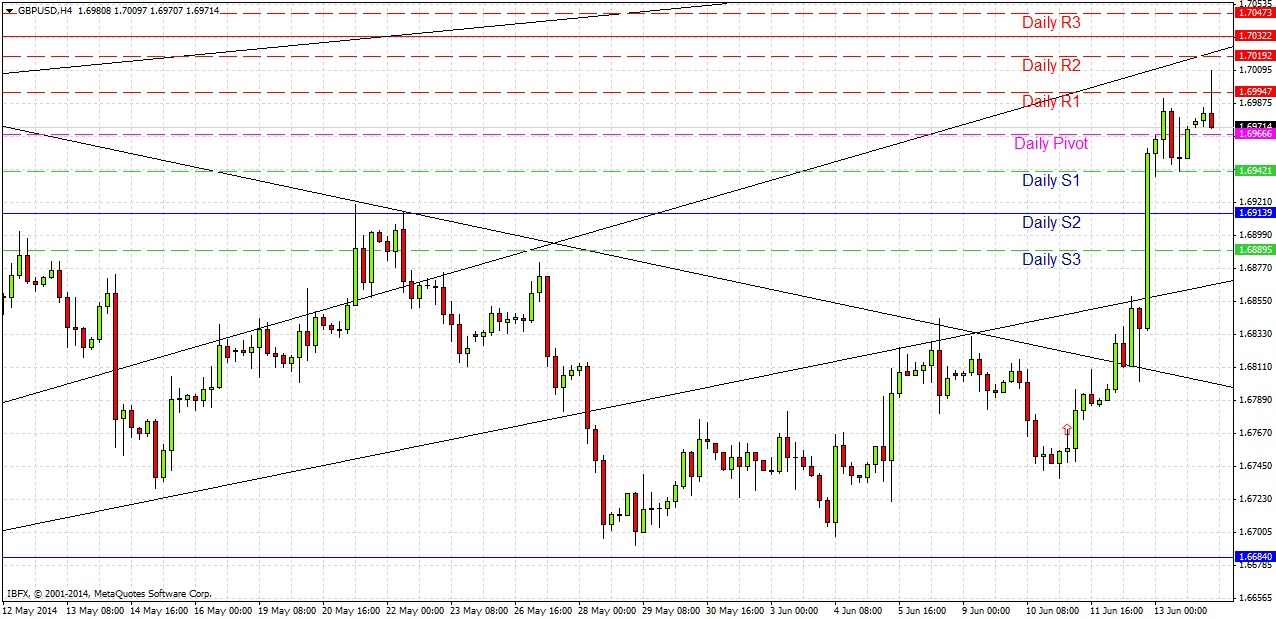

Today’s GBP/USD Signals

Risk 0.75%.

Entries can only be made between 8am and 5pm London time today.

Short Trade 1

Short entry following bearish price action on the H1 time frame following the first touch of 1.7032.

Place the stop loss one pip above the swing high.

Adjust the stop loss to break even when the price reaches 1.6970.

Take off 75% of the position as profit at 1.6970 and leave the remainder of the position to run.

Long Trade 1

Long entry following bullish price action on the H1 time frame following the first touch of 1.6914.

Place the stop loss one pip below the swing high.

Adjust the stop loss to break even when the price reaches 1.6990.

Take off 75% of the position as profit at 1.6990 and leave the remainder of the position to run.

GBP/USD Analysis

Since last Thursday’s analysis, there is renewed bullishness in the GBP following the Governor of the Bank of England’s indication that there is likely to be rate rise later this year. This caused the price to shoot up, and it reached a multi-year high earlier this morning just above 1.7000, from which it is falling off at the time of writing.

The bullish move cut clean through the forecast resistance level at 1.6914, which can now be expected to turn into flipped support. This could provide a good long trade opportunity if the price action is right. This level is also exactly confluent with today’s S2 GMT pivot point, which should strengthen it a little.

Above us there is resistance at 1.7032 and quite close to that there is also a minor upper channel trend line. If we get back up there today it could be a good place for a conservative short trade.

Overall bias should be bullish now.

There are no high-impact news events scheduled for today concerning either the EUR or the USD, so it might be a very day for this pair, although the recent sharp move may cause some more movement today.