The XAU/USD pair scored a gain of 5.3% on a monthly basis as the U.S. Federal Reserve’s dovish stance and geopolitical unrest in Iraq and Ukraine buoyed the precious metal’s appeal. Aside from heightened need for disaster insurance, disappointing numbers out of the United States had an impact on the market sentiment. Data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 120859 contracts, the highest level in 14 weeks.

Statistics show that the precious metal has a tendency to rise in July. However, the market has been lacking a clear driver -for the last five months at least- and that raises some doubts over whether the prices will be able to climb when the geopolitical issues simmers down. But of course this might be a bit early to consider because unlike Ukrainian situation, the conflict in Iraq can’t be resolved diplomatically.

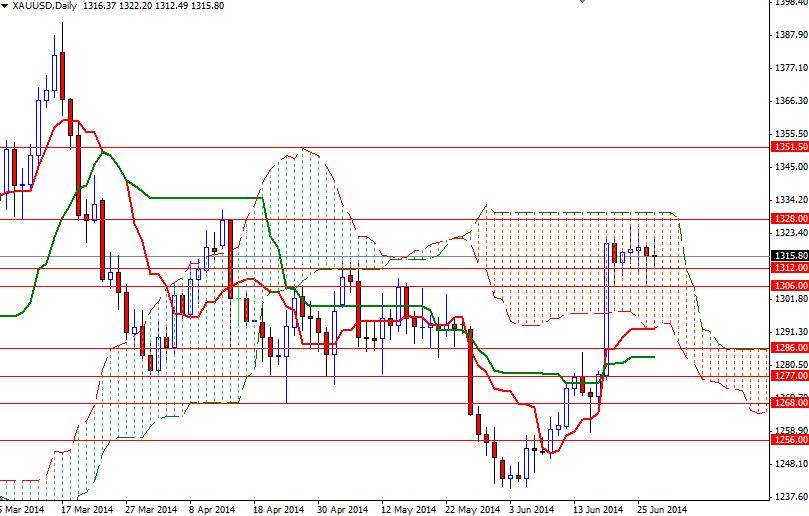

With that in mind, I think gold prices to grind higher gradually. Technically, it would be reasonable to expect prices to hold above the $1306 level. In order to confirm that the bulls will be controlling the market, the XAU/USD pair has to anchor to somewhere above the top of the Ichimoku cloud (the 1328/31 area which also happens to be a former support/resistance) on the daily time frame. If that is the case, the market could go as high as $1360 an ounce. On its way up there will be critical hurdles such as 1334, 1340 and 1352. If the American dollar gets a boost from the upcoming fundamentals and the bears successfully push the pair below the 1306 level, selling could continue to the next support area between 1300 and 1297. The bears will need to capture this point so that they can march towards 1287/6.