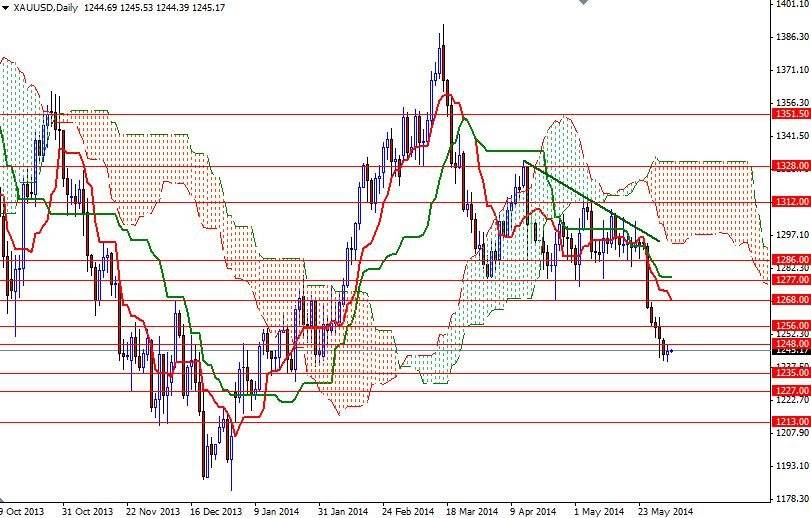

The XAU/USD pair settled slightly higher on Tuesday, marking the first rise in seven trading sessions, as caution set in ahead of high impact economic data releases later this week. The pair tried to pass the first resistance level of 1248 but as you can see the market is still feeling the bearish pressure of last week’s breakout. Investors appear to be losing faith in the precious metal as the dominant up-trend in equities, along with lower demand from China weigh on prices.

Pattern on the weekly chart suggest that gold prices could go as low as $1180 an ounce over the next couple of months. However, we should always keep in mind that markets do not rise or fall in straight lines. Because of that, I will keep an eye on the 1240 level which attracted some buyers for the last two days. If buyers parry the bears’ attacks and push prices above 1248/51 resistance zone, we will probably see the market visiting 1256/60. Technically, the bulls will have to break through that area in order to gain enough momentum to start a journey towards the 1268 resistance level.

If the bears continue to dominate the market and the XAU/USD pair drops below 1240, it is likely that we will test the support at 1235. A close below 1235 would suggest that the pair may extend its losses and target the 1227 support next. I think market players will be waiting for the Fed’s Beige Book, ISM’s services PMI and ADP’s non-farm employment change report before putting larger bets.