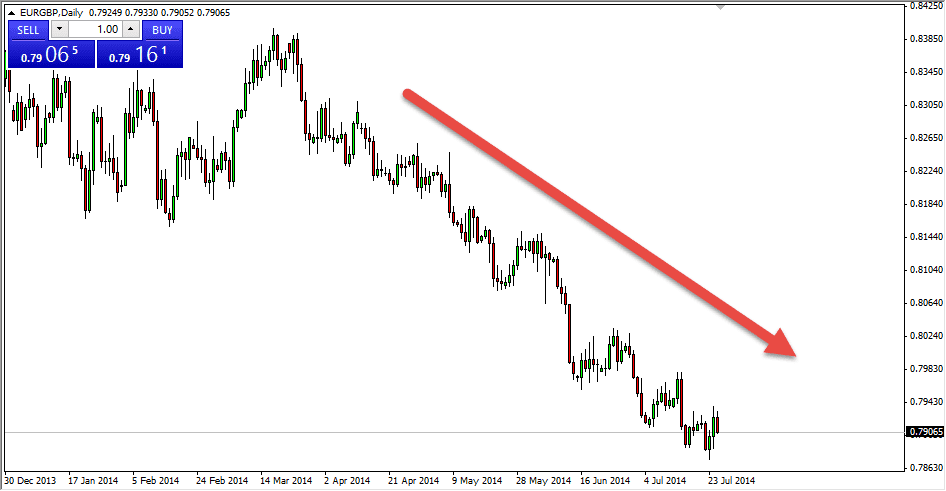

The EUR/GBP pair fell during the day on Friday, continuing the bearish pressure that we have seen for some time. Quite frankly, I feel that the market breaking below the 0.80 level was in fact significant, and as a result I believe that we have started the next leg lower. With that, I anticipate seeing this market head to the 0.7750 level, and then possibly even lower than that, down to the 0.75 handle. That of course is a bit of a longer-term target, but ultimately I think it does get hit.

That being the case, I am still selling rallies on short-term charts, any time I see any sense of weakness. It really has been a very steady downtrend, but recognize that the choppiness we are seeing on the charts really isn’t anything new, this pair tends the chop around a lot anyway. With that, I’m hoping to be able to come back to this market time and time again, and I believe it will get especially interesting to the downside if the market gets a boost from the GBP/USD pair breaking back above the 1.70 handle.

The Euro is broken at the moment, and I don’t see this changing.

The euro is broken at the moment, and probably heading to the 1.33 handling the EUR/USD pair. That being said, I think it will continue the pressure to the downside on the euro itself, and that of course will show itself in this market also. If the British pound can also pick up enough momentum to the upside, then you have the “double whammy effect”, allowing for a bit of a one-way market going forward.

I don’t know if that’ll happen right away, but I do fully anticipate seeing a continuation to the downside. In fact, I don’t see any interest in buying this market until we get back above the 0.8150 level, something that seems very unlikely at the moment. Without, I am essentially in the “sell only” camp, and believe that most other traders are probably thinking the same thing.