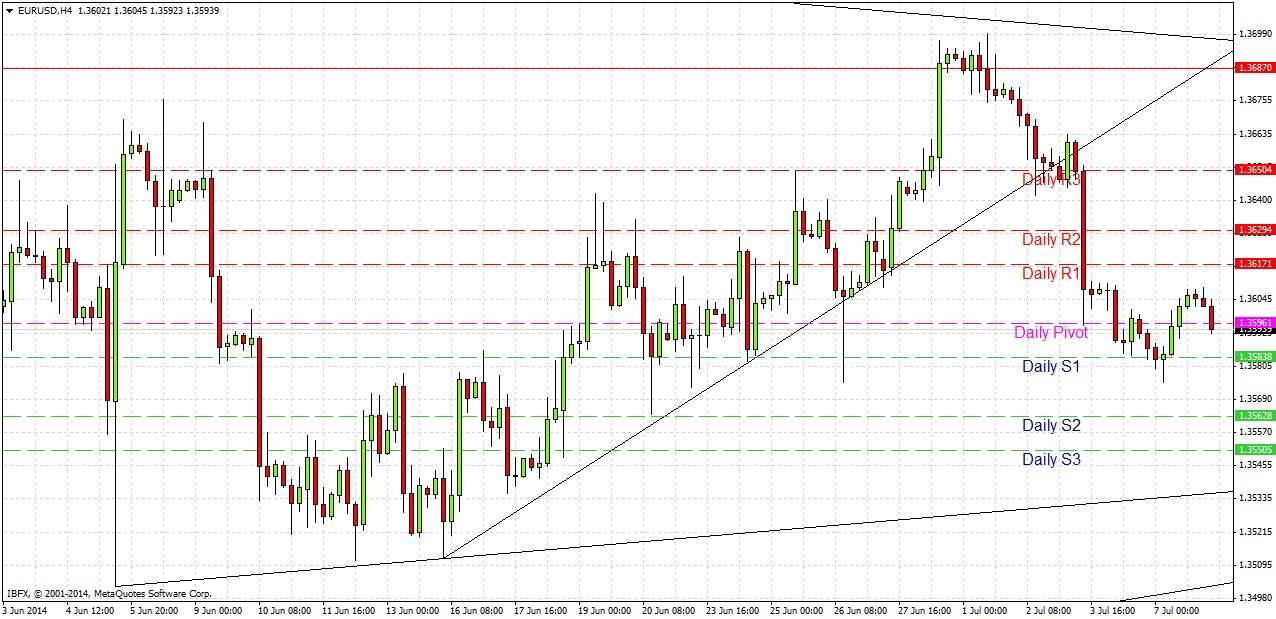

EUR/USD Signal Update

Yesterday’s signals were not triggered as the price never reached either the bullish trend line or 1.3687.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries may only be made between 8am and 5pm London time today.

Long Trade 1

Long entry following bearish price action on the H1 time frame after the first touch of the bullish trend line currently sitting at about 1.3535.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.3570.

Remove 75% of the position as profit at 1.3570 and leave the remainder of the position to ride.

Short Trade 1

Short entry following bearish price action on the H1 time frame after the first touch of 1.3687.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.3610.

Remove 75% of the position as profit at 1.3610 and leave the remainder of the position to ride.

EUR/USD Analysis

As expected, yesterday was a very quiet day, with a total range of only about 33 pips on the GMT daily candle, which was hardly more than the range from 4th July, which was a major public holiday. I did write yesterday morning that the area at around 1.3575 might prove to be supportive enough to have set the low for the day and I was right about that. Yesterday was actually the first up day for the whole previous week.

We cannot really take any new information from yesterday except that there is the possibility we might have formed the low for a few days or even the week, although the move up so far can hardly be called strong.

It is likely that we will again have a very quiet day today as there is no important news due for either side of this currency pair.

We are almost halfway between the closest important levels which are currently 1.3535 and 1.3687. My colleague Christopher Lewis agrees with me, saying we are “in the middle of no-man’s land”.

There are no high-impact data releases scheduled for today concerning either the EUR or the USD. Therefore it is likely to be a very quiet day.