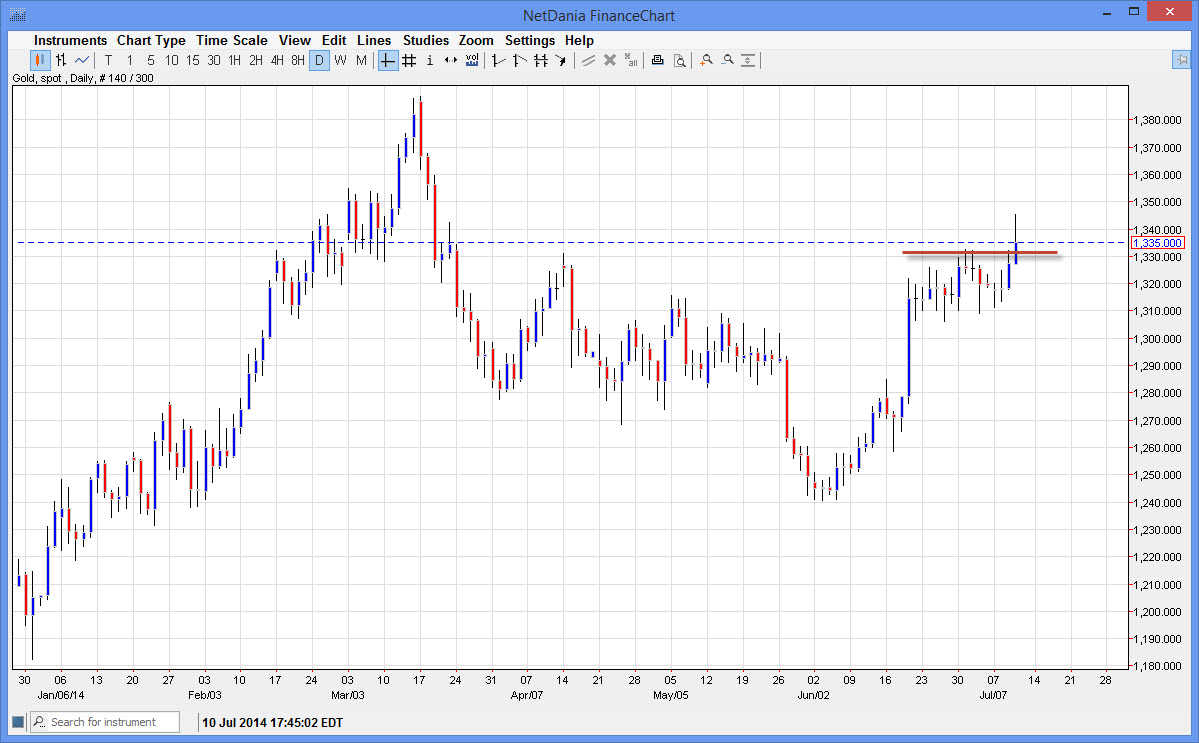

The gold markets rose higher during the session on Thursday, piercing the $1335 level. This was an area that I have been looking at as massive resistance, and the fact that we broke above there makes me believe that the market could very easily go higher. However, when I cannot get around is the fact that the market pulled back and gave back quite a bit of the gains for the day. The resulting candle is a bit of a shooting star, and that of course is a very negative sign. However, looking at the shorter-term charts I believe that we could have a buy signal somewhere just below and could continue to try to break higher towards the $1350 level. That area in my opinion is a significant amount resistance, but once we get above there we should continue to go to the $1400 region.

Impulsive move higher, followed by a rest. Now are we breaking out?

This market had a massively impulsive move higher, followed by a sideways action which is something that we see often. The uptrend in move it looks like it’s ready to continue, and I also believe that the gold markets were sold off way too drastically earlier this year. With that being the case, I have been very patient, but it now appears that the market is ready to continue going higher. If we continue to see all of this uncertainty in the marketplace, I believe that short-term traders will continue to push this market higher and higher, but it is in fact going to be very choppy. With that being the case, I have been very careful, but have been buying most of my gold in physical form.

There are many different gold markets out there to trade. CFD markets of course offer you plenty of versatility when it comes to position size, but there are also mini contracts available in the gold futures pits as well, and that of course allows us to play gold markets in several different ways. Another possibility of course is the options market, but that being the case there are plenty opportunities in this market. I have absolutely no interest in selling.