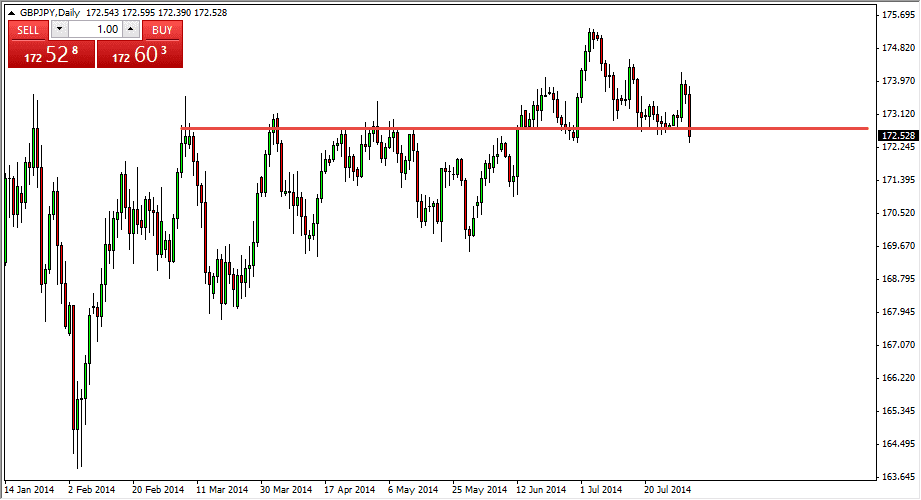

The GBP/JPY pair fell rather harsh during the session on Friday as the British pound got hammered against most currencies around the world. However, we are most certainly sitting on significant support them through 176.50 region, so therefore I feel that this market could get a bit of about. Regardless though, the fact is that we are starting to see weakness in the British pound across the works, so it is very possible that we do in fact breakdown. With that in mind, I am very hesitant to place a position one way or the other at the moment, as I need to see some type of support candle in order to find, and definitely some type of breakdown in order to sell.

The British pound seems to be struggling against most currencies, and the fact that the Japanese yen is more or less a safety currency doesn’t help the situation in this particular pair, as it exacerbates the issues between the two economies. With that, I feel that the market is probably one be very volatile, so if you do find yourself trading the pound versus the yen you may want to do it via the options market, or perhaps even better the binary options market if you have that ability.

Short-term trades

I believe that most of the Forex market at the moment probably based around a short-term charts, as August tends to bring in holiday for large accounts and hedge funds around the world. In fact, August has some of the lowest liquidity for the year, and the fact is that this year is been very low volatility for some time now anyways.

I believe that a breakdown since this pair down to the 172 handle first, and then as low as 170. On the other hand, we bounced, the British pound should be valued at roughly 174 against the Japanese yen, given enough time. I think if we break above there though, then we returned to the uptrend, and it could be more of a buy-and-hold situation.