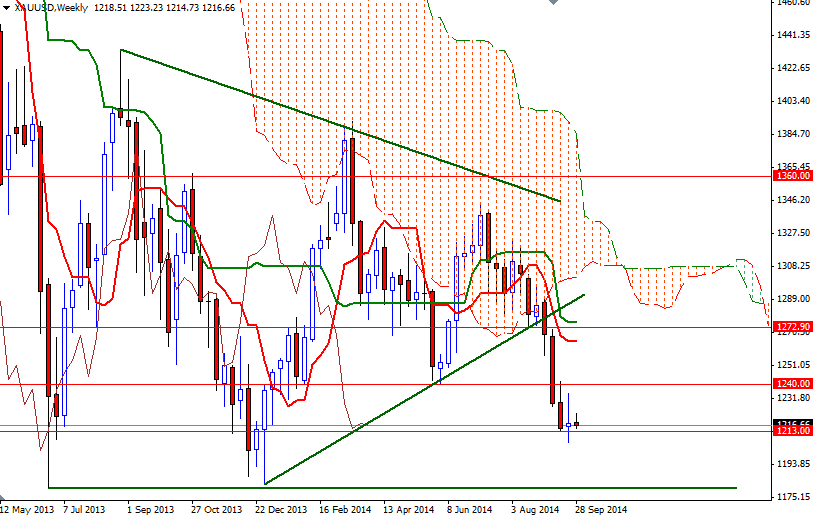

Gold prices suffered a monthly loss of nearly 5.5% as a rally in the U.S. dollar and gains in the major stock markets dulled the precious metal's attractiveness. The greenback is being given a lift by a series of strong economic data which bolstered expectations for an earlier-than-expected rate hike from the Federal Reserve. The Fed chair Janet Yellen has been trying to keep the markets away from speculation on rate hikes but the investors started pricing in changes in the central bank’s monetary policy several weeks ago. However, this was not a big surprise because as you will remember the XAU/USD pair had broken below the $1532 support level (which had been the bottom for a pretty long time) before the Federal Open Market Committee actually pulled trigger to down the tap on its $85billion/month stimulus package.

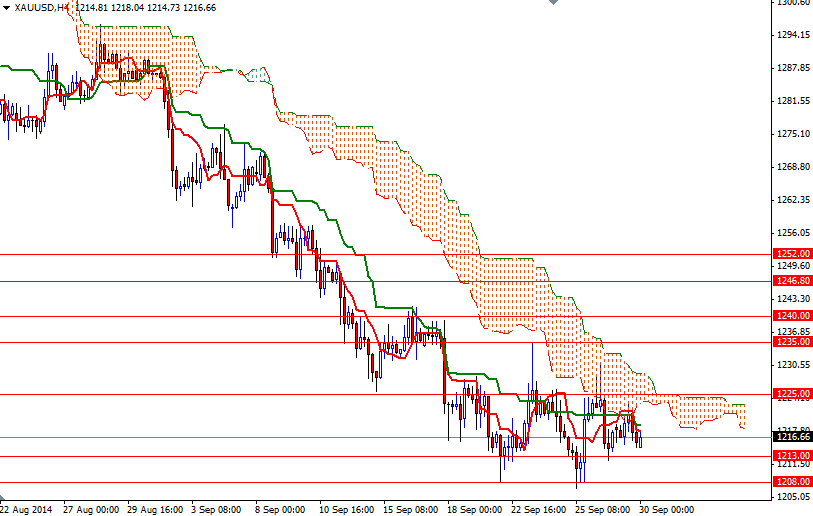

I think the first week of October will be important for the market as prices are showing a tightening trading range, which is symptomatic of a pending strong move, either way. Although bearish technical formation on the weekly and daily charts suggests there is still some room for the pair to sink, I will be watching the 1235 and 1208 levels before I take any action. If the American dollar gets a boost from the upcoming fundamentals and the XAU/USD pair successfully falls below the 1208 level, it is very likely that we will see the 1200 support being tested next. Closing below the 1200 level would make me think that the last year's low of 1180 will be challenged afterwards. The bears will have to capture this strategic castle in order to start a journey to the 1050/38 area.

On the other hand, passing through the 1235 resistance level would suggest that the bears will have to wait a little longer. Since that would carry the market beyond the Ichimoku clouds on the 4-hour time frame, pressure from bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses might ease. If the market anchors somewhere above the 1240 level, we will probably see a bullish continuation and reach the critical 1252/60 resistance zone level which might attract some serious sellers.