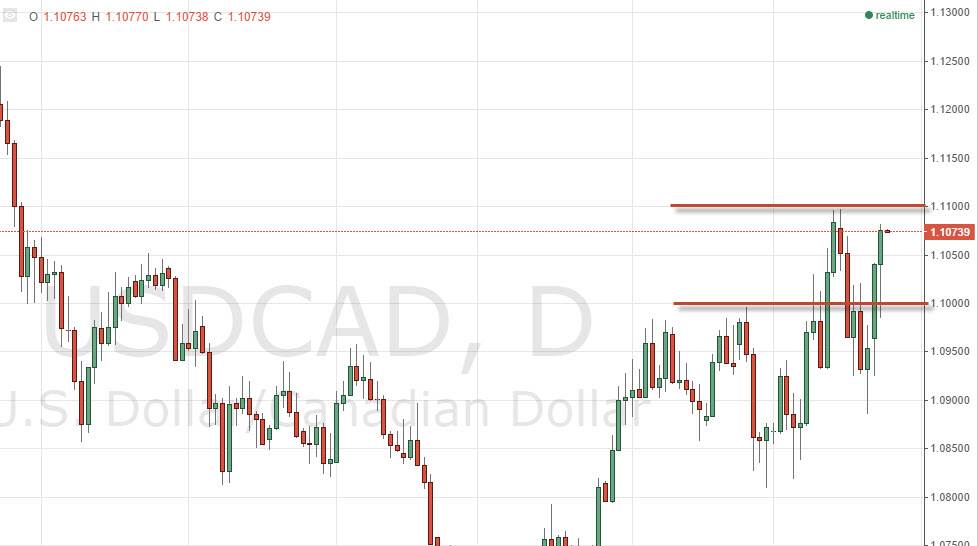

The USD/CAD pair initially fell during the course of the day on Tuesday, finding support at the 1.10 level during the middle of the session, and then bouncing significantly in order to form a nice-looking hammer. This hammer in my opinion suggests that the market is ready to go above the 1.11 level, and head towards the 1.12 level. The trend is most certainly to the upside recently, at least since July. With that being the case, I am looking for opportunities to buy this pair, and I think that short-term pullbacks should offer those chances.

This is a bit of a “perfect storm” as the oil markets certainly aren’t helping the value of the Canadian dollar overall. Because of that, I think that there will continue to be bearish pressure on the Canadian dollar because of this, and on the other side of the equation you have to acknowledge the fact that the US dollar continues to be favored by most currency traders around the world. With that, I think that the pair could continue to go higher given enough time, but keep in mind that this pair tends to be rather choppy in general. This of course is due to the fact that the two economies are sell interconnected, as the Canadians send 85% of their exports into the United States.

Longer-term outlook.

Look at this chart, I think that this is going to take some time, but think of it more as an investment than anything else. After all, the United States continues to be favored in general, and although the Canadian dollar does look a bit weak on this chart, keep in mind that it is a North American currency and money seems to want to flow to the North American continent right now. Because of that, I think this market will continue to go higher binds you are going to have to be very patient, and perhaps scaling to a position over time in order to take advantage of this move going forward.