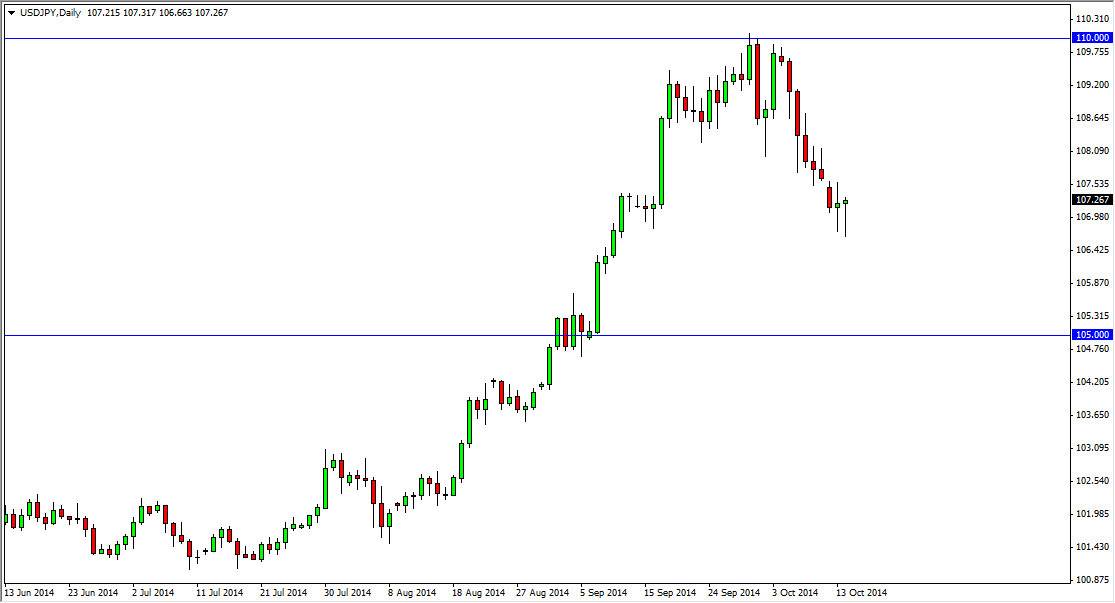

The USD/JPY pair fell again during the session initially on Tuesday, but bounced in order to form a hammer for the second day in a row. This supports seems to be focused on the 107 level, an area that has been supportive and resistive in the past. Because of this, I feel that the market probably is ready to start bouncing again, but we need to break above the top of the hammer for the session on Tuesday in order for me to feel comfortable buying. At that point in time, I believe that we go to the 110 level given enough time. Actually, I think that we will sooner or later anyway but this is the entry point that I am looking for.

Even if we fell from here, I would anticipate seeing support somewhere between here and 105. I believe that the 105 level is the “floor” in this marketplace, as the Bank of Japan continues to work against the value of the Yen. On the other side the Pacific, we have the Federal Reserve at least looking slightly hawkish, even though there has been a bit of confusion lately.

Continued uptrend.

I believe that we are in a longer-term uptrend, and that we will continue to see this market go much higher over the course of the next several years. I believe that pullbacks will continue to be buying opportunities, much like years ago when we had the “carry trade” in full effect, as traders would simply sell the Japanese yen every time it strengthened. This was one of those currency pairs that people loved to start buying, every time it fell. There were other ones of course as well, but ultimately this market should continue to act in the way it has over the last several months, simply offering buying opportunity again and again.

Selling this currency pair at the moment is something that I have no plans on doing. In fact, I believe that a lot of currency traders will make their careers based upon going long of this market over the next several years.