By: YesOption

A series of challenges affecting the dairy industry caused the U.S. largest milk processor Dean Foods Co (NYSE:DF) to a loss of $16 million or 17 cents a share in Q3. The results are quite disappointing, when compared to last year.

Chief Executive Officer, Gregg Tanner on a conference call reiterated that 2014 has so far been the most difficult operating environment but still remains upbeat, thinking that things will change for the better going forward. The CEO reiterated that Deans Foods remains focused on things it can control. This includes price realization, cost productivity and margins that can deliver an appropriate return.

Despite the challenging operating environment, Chief Financial Officer, Chris Bellairs stated Dean Foods delivered a sequential improvement in operating income. The margins achieved in the third quarter are expected to form the basis for profitability heading into 2015.

Net sales for the third quarter came in at $2.4 billion up from $2.2 billion that was generated in the Q3 of 2013. This is in fact one of the reasons why Wall Street continues to remain upbeat on the stock. Dean’s Foods third quarter operating loss however, was $1 million compared to an operating income of $23 million generated in Q3 in 2013.

The company’s unadjusted milk volumes were declining over 1% on a year-over-year basis, reflecting the negative impact of the RFP-driven volume loss in 2013. Dean Foods’ net cash from continuing operations in the quarter came in at $48 million, with a net debt of $30 million.

Despite the ongoing challenges, the company remains confident of delivering improved results going forward as butterfat costs decline. Dean Foods expects to post diluted earnings between $0.05 and $0.15 in the upcoming fourth quarter, along with a full year net-loss between $0.06 and $0.16 a share.

Technical Analysis

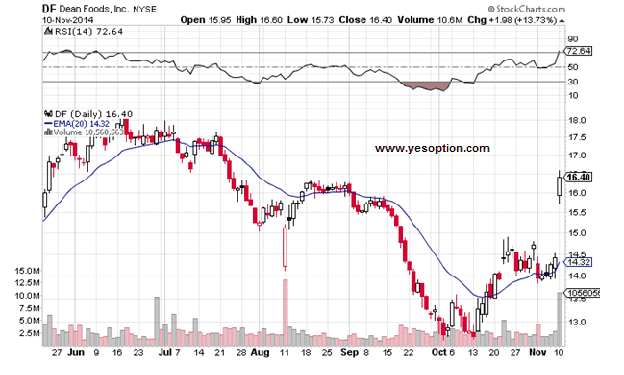

Dean Foods, after trading in narrow range saw some very good price and volume action during yesterday’s trading session. The stock surged by 13.73% to close at $16.40 with volumes of 10.56 million shares, which was over five times more than its average volume of 2.57 million. Dean Foods’ stock is not only trading above its 20-day EMA of $14.32 but it opened with a huge gap on the upside. Momentum indicators like the RSI indicate the rally has the potential to continue for another session or two.

Actionable Insight:

Buy Dean Foods Co (NYSE:DF) for target of $16.8 and $17, with stop-loss of $16.15