The XAU/USD pair fell over the course of the day on Monday, giving up some of the recent gains, as the global stock markets advanced and the greenback rebounded. Gold traded as low as $1147.25 an ounce after the market pulled back below the 1164/0 support zone. On the one side we have continued ETF outflows and speculators cutting bullish bets on COMEX, while on the other hand the precious metal is finding some support from increasing demand for coins and bars amongst retail investors. Last Friday's data from the Commodity Futures Trading Commission (CFTC) had revealed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 63225 contracts, from 100721 a week earlier.

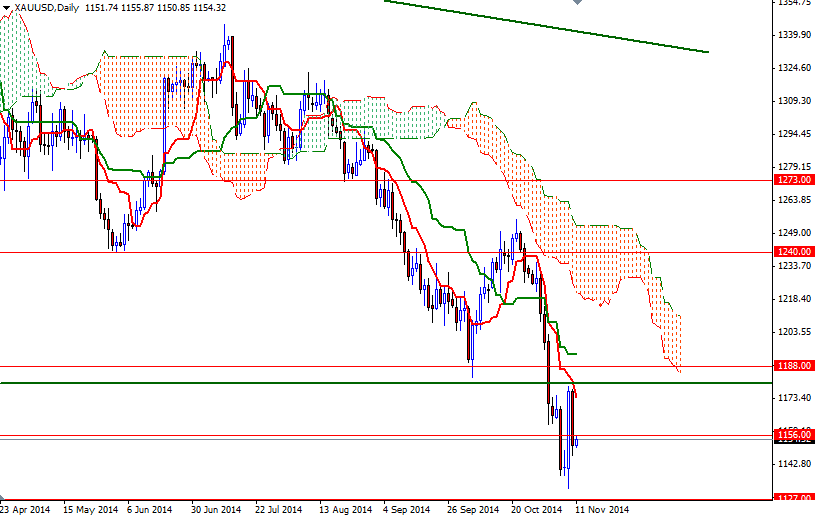

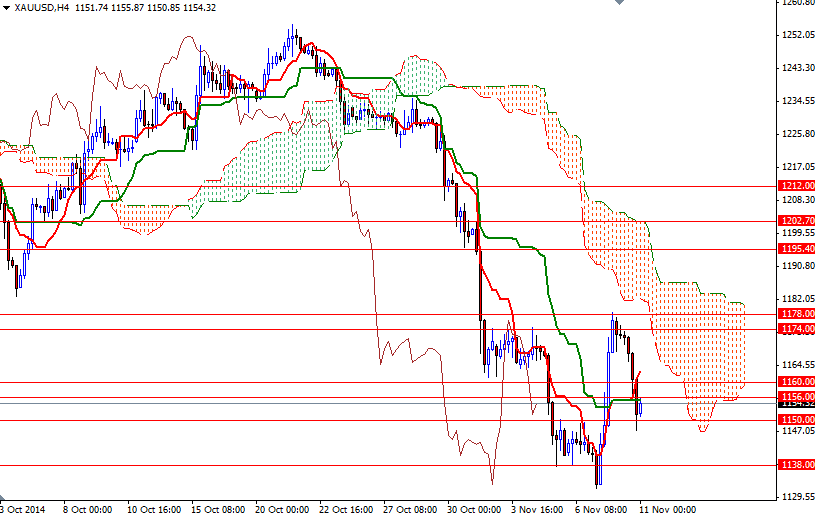

It appears that prices found some support above the 1150 level during the Asian session today but the Ichimoku cloud is right on top of us (4-hour chart). The Ichimoku cloud indicates an area of support or resistance and in our case clouds are representing resistance zones. In addition to this negative situation, we have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross and the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices on the daily time frame.

Until the market anchors above the cloud -on the 4-hour time frame at least- there won't be any technical reason to buy gold. I think the bulls will need to push the market above the 1164/0 area so that they can test the next barrier located at 1178/4. Since there is significant amount of pressure between the 1183 and 1188 levels, only shattering this barrier on a daily basis could provide the bulls the extra fuel they need to begin a journey towards the 1212 level. To the down side, expect to see some support at 1150 and 1145. In order to increase the downward pressure and revisit 1138 (or even 1132), I think breaking below 1145 is essential.