McDonald's Corporation (NYSE:MCD) is one of the many fast-food joints that continues to benefit a great deal from system upgrades in order to support online orders. In the U.S alone, web and mobile orders account for 50-60% of the total sales according the Economic Times.

McDonald's just like other companies continues to benefit from widespread smartphone use. Most of the fast-food joints are incorporating these new operating systems, slashing the once prohibitive costs incurred with call centers. Online portals allow customers to route their orders directly from the website to stores that are close to them

Customers on the move or in a hurry are the ones that continue to benefit a great deal from this new development. Online Ordering additionally helps McDonald's inform customers of their offers, promotions and new menus as opposed to phone ordering.

Sheer convenience is one of the reasons why online ordering is gaining momentum as a number of customers especially in today’s day and age are rarely seen without their smartphones or tablets. When customers place orders an alert pops up on a kitchen screen, allowing these retailers to save on costs and time.

In India for instance, McDonald's franchises have been forced to revamp their online portals in response to increased online growth. The upgrade is already bearing fruits, as seen by Hardcastle Restaurants, which recently reported over 30% growth in its online business, up from just 5%. Hardcastle runs a total of 192 restaurants in the region.

Yum Restaurants, which is a subset of KFC remains one of the fastest growing restaurants in India, with online deliveries accounting for a quarter of total sales.

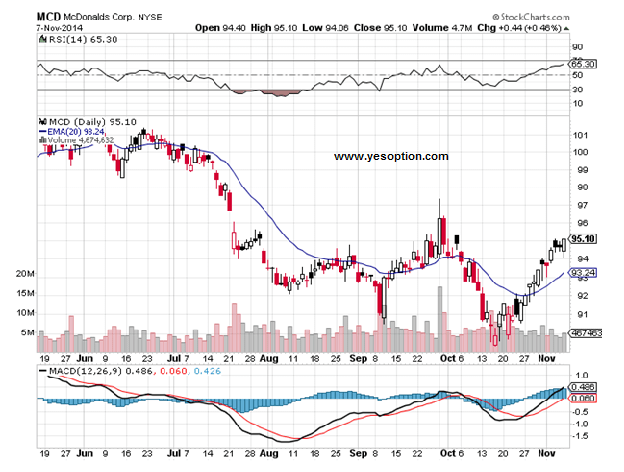

Technical Analysis

McDonald's, after opening at $94.4 moved up marginally in Friday’s trading session to close at $95.10. The stock has been on the rise since October 26th supporting a strong upwards trend. It is currently trading above its 20-day EMA of $93.24 with an RSI of 65.30, indicating that the stock is getting awfully close to an overbought zone.

Traders can go long on the stock with support of $94.5 and $93.24, whereas resistance is expected near $96, $97.50.

Actionable Insight

Buy McDonald's Corporation (NYSE:MCD) with a stop-loss of $94.6, for target of $95.70, $96.50.