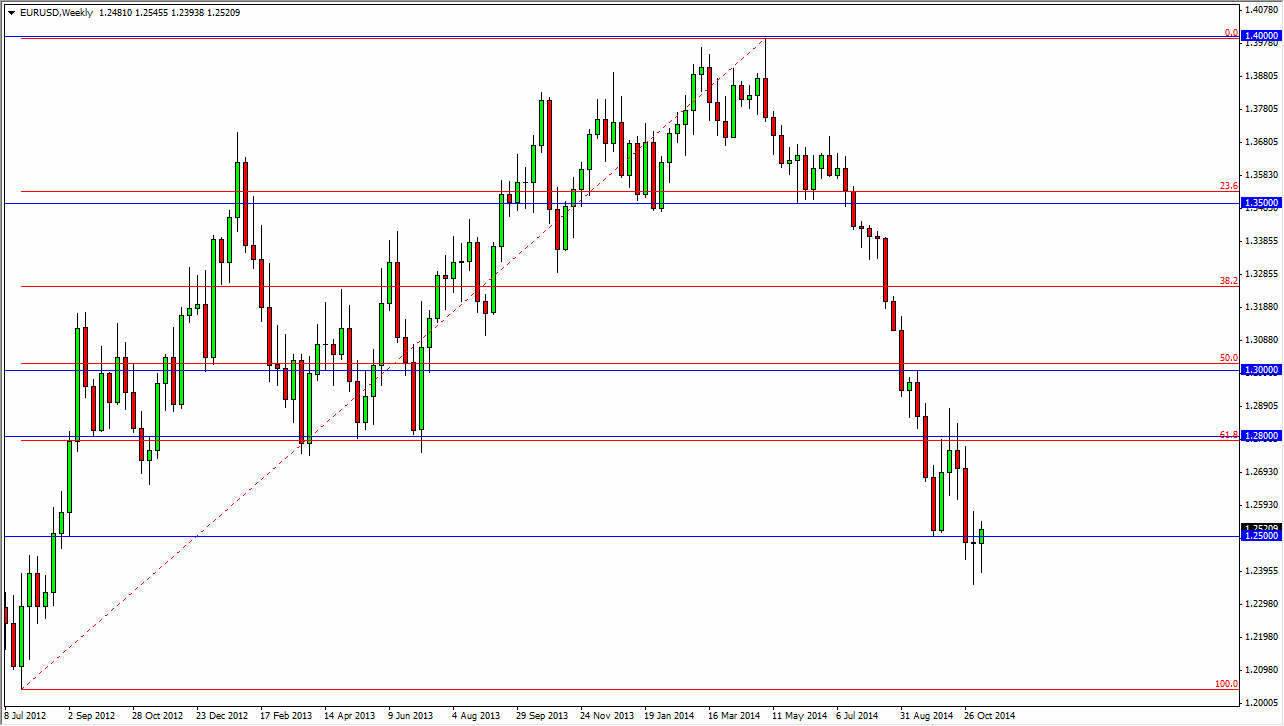

EUR/USD

The EUR/USD pair fell during a majority of the week, but as you can see found enough buying pressure underneath the turn things back around and form a nice-looking hammer. The hammer of course is a good sign for the buyers, and although it does look positive I don’t really have too much of an interest in buying this market. I simply think that this will be a bounce again, and that we will more than likely see sellers come in somewhere between here and the 1.28 level. Because of this, I think that this is a bounce you can take advantage of in order to start selling again, but not right this moment.

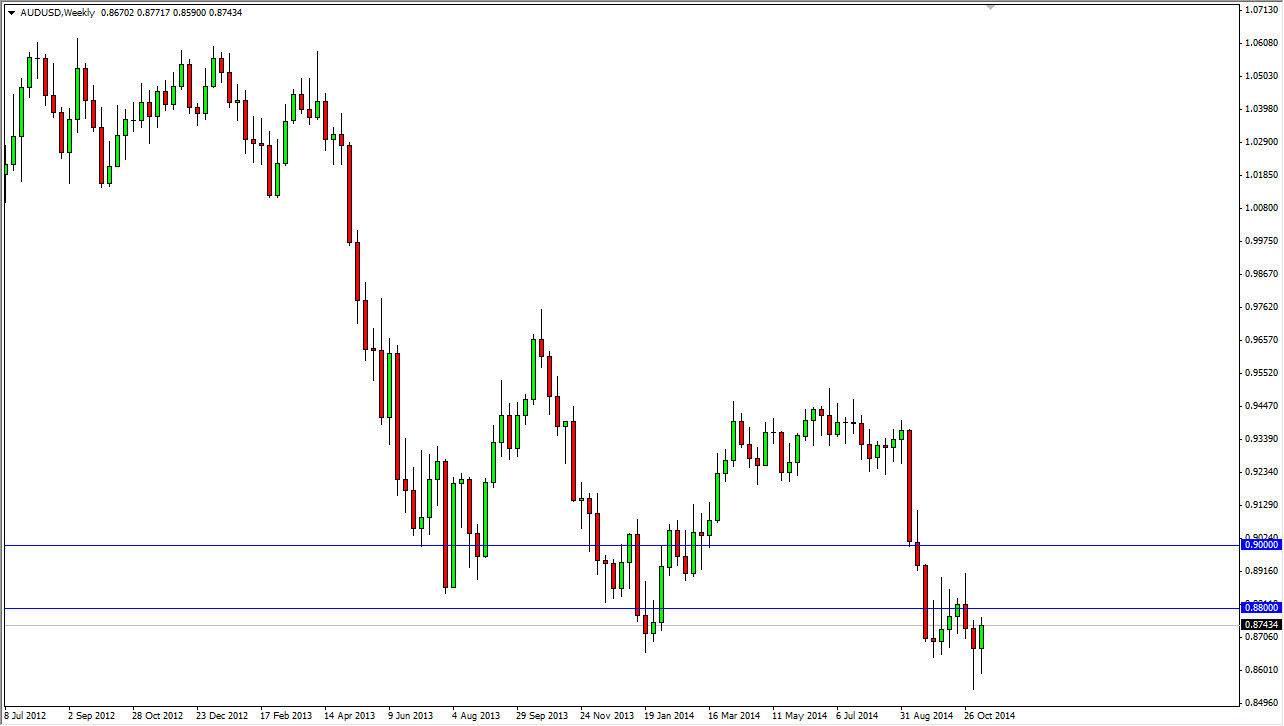

AUD/USD

The AUD/USD pair fell during the beginning of the week, but did find enough buyers to turn around and form a hammer. This hammer of course suggests that we could bounce from here but there is a significant amount of resistance just above. Ultimately, I feel that this market will go a bit lower but we certainly don’t have the candle to start shorting yet. With that, I am bearish but also going to be very patient.

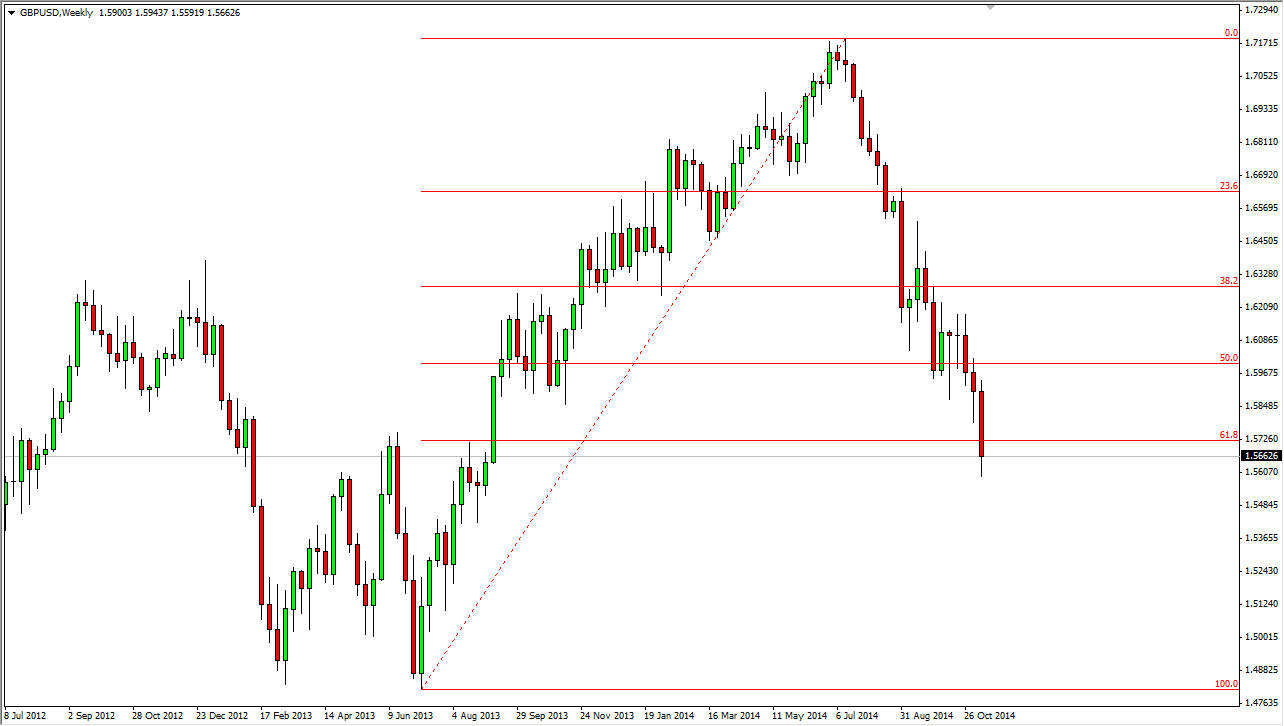

GBP/USD

The GBP/USD pair broke down during the course of the week, and sliced through the city 1.8 Fibonacci retracement level. Ultimately though, we did form a hammer on Friday, so that could be a short-term bounce first before we continue to go lower. When you look back towards the beginning of 2013, you can see that there is a significant amount of noise in this general vicinity. Because of that, I think that although we are going to go lower, it’s going to be a bumpy ride from here. I am bearish of this market on rallies though.

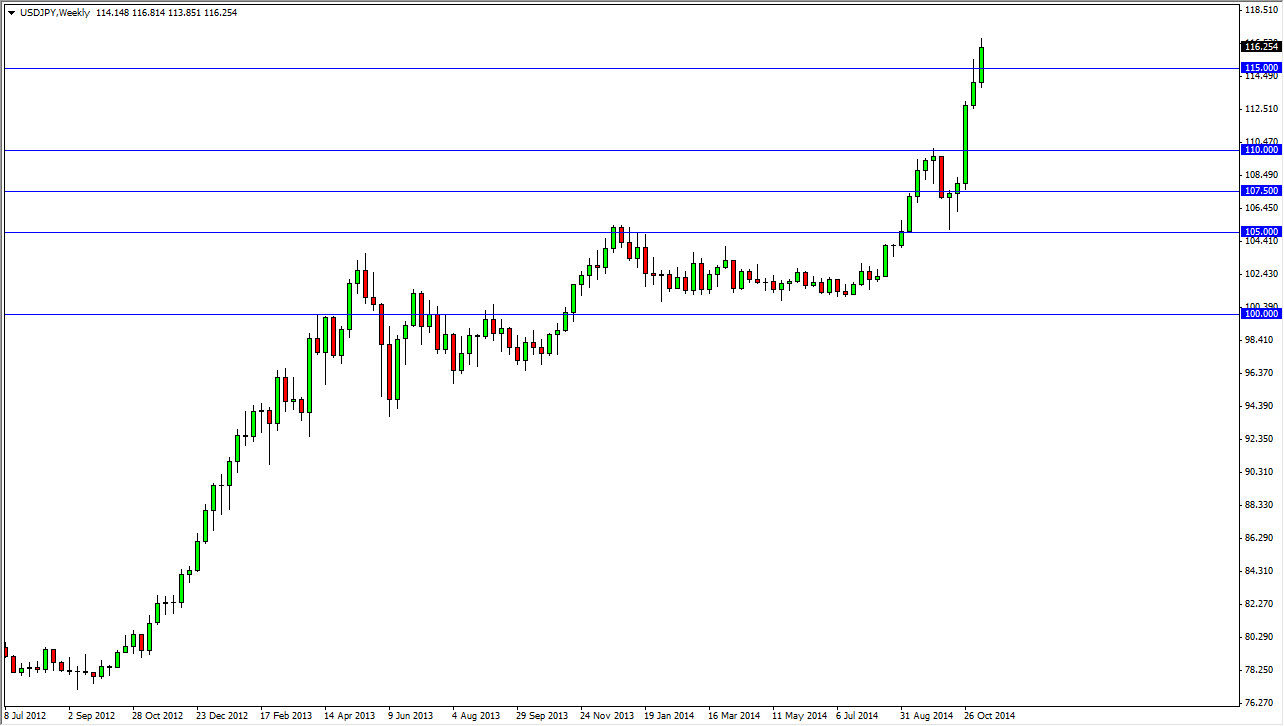

USD/JPY

The USD/JPY pair broke out during the course of the week, and finally close well above the 115 level. Because of this, I feel that this market is going to continue to go higher, and that any pullback at this point time is simply a buying opportunity. Look at dips as potential “value” in the US dollar, as the Federal Reserve have stepped out of the quantitative easing game, while the Bank of Japan looks to step on the accelerator. I believe that this pair is in a multi-year long-term uptrend.