By: YesOption

A number of Japanese scholars have co-authored a paper, termed as “improved Bitcoin”, with the hope of it creating a better, low-volatility digital currency. Its overly volatile nature and increased speculative measures have kept many investors away from the digital currency. These scholars are of the view that if their method is implemented it would be able to create more stability for digital currency with or without central bank intervention, which should ultimately be able to attract a wider audience. Of course this is tremendously positive according to industry analysts.

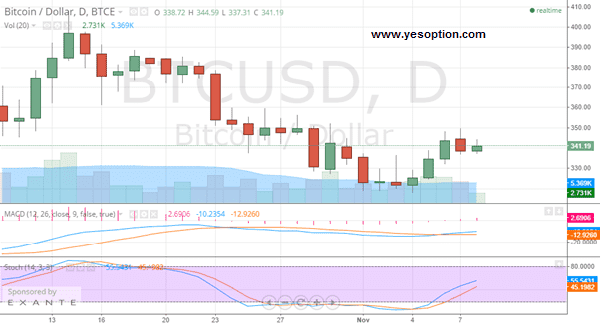

The BTC/USD continues to find itself in a narrow trading range and has so far been unable to cross the resistance zone near the $345 level. The crypto-currency is forming lower-highs and lower-lows, indicative of the fact that bears are using all rallies as selling opportunities.

The absence of buying interest at higher levels has many experts worried as they believe that interest from the BTC/USD marketplace is fading away quiet dramatically. The BTC/USD is currently trading below its important daily moving averages, while the stochastic oscillator is showing its first sign of reversing, indicating a sell signal, which confirms strong selling pressure.

Meanwhile, the momentum indicator for the BTC/USD continues to trade in the bearish zone and points toward an impending downwards turn. Lastly, support for the BTC/USD is now situated near the $320 level.

Actionable Insight:

Short the BTC/USD if it moves below $321 for an intermediate target at $280, with a strict stop loss above $345

Long the BTC/USD if it moves above $345 for an intermediate target at $367, with a strict stop loss below $321.