By: Stephanie Brown

Internet sensation Baidu Inc. (ADR) (NASDAQ:BIDU) is taking a keen interest in taxi-hailing app Uber. The Chinese giant has reportedly made over a $600 million investment in Uber, with full details set to be made public at an upcoming press conference on December 17th.

Its investment in Uber will help Baidu increase its market penetration in the local services’ industry in China, as the race for precious market share heats up. Baidu believes that this will increase its traffic and fend off potential competition from Alibaba.

Uber is the richest privately held company after receiving $40 billion worth of funding. Despite enjoying impressive operation metrics in the U.S., Uber is still facing regulatory scrutiny in Thailand and Spain where its services have already been halted.

Baidu has been boosting its online presence in the wake of Alibaba going public. Based in China, Baidu is seen as the Google Inc. (NASDAQ:GOOGL) of the country as it continues to poses tremendous market share thanks to its founder, Robin Li. This investment is expected to heavily expand Uber’s presence in China and is causing many to wonder if or when it will go public.

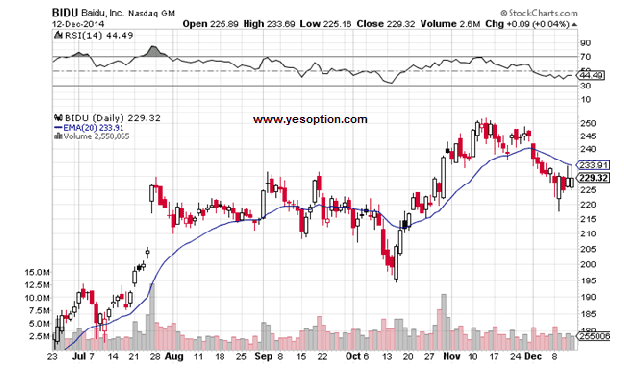

Technical Analysis

Baidu traded in a wide range during Friday’s session with over 2.6M volumes worth of shares exchanging hands. The stock is currently situated above its 20-Day EMA of $233.91, with an RSI of 44.49. Lastly, it is facing resistance near $235, $240 on the upside, while finding support at $225.5, $220.

Actionable Insight

Buy Baidu Inc. (ADR) (NASDAQ:BIDU) above $231 for target of $234, $238 with stop-loss of $229.8