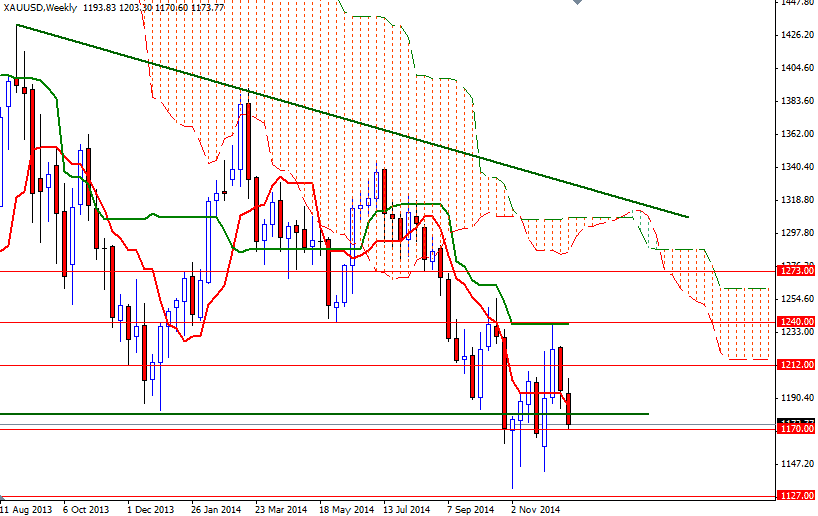

Gold has been on the back foot since the bears defeated the bulls on the 1235/40 battlefield.

A collapse in oil prices curbed demand for the metal as an inflation hedge and a friendly risk environment encouraged investors to put their cash into higher yielding assets such as equities. Also, the weight of expected interest-rate rises from the U.S. has been negatively influencing gold prices. As a result, the market returned to the $1170 support area.

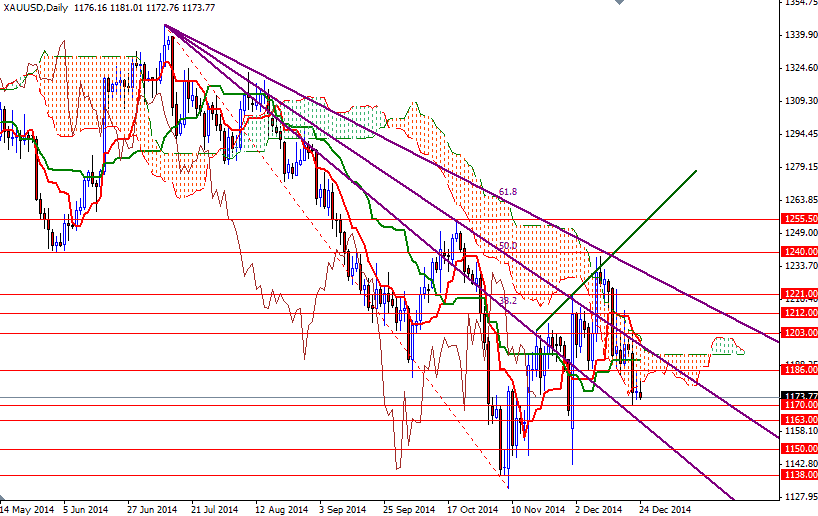

The technical outlook remains bearish while the XAU/USD pair trades below the Ichimoku clouds on almost all time frames. In addition to that, on the weekly and 4-hour charts, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned. However, the pair held up pretty well considering the greenback continued to advance and because of that I can't rule out a rebound towards the 1186 - 1194 area where the daily could currently sits. If we climb above the Ichimoku cloud on the daily chart, then there will be a possibility that prices may retest the 1203 resistance level.

On the other hand, if the market resumes its bearish sentiment and prices drops below the 1170 support level which I have been keeping an eye on since Monday, I think we will test 1163 next. A daily close below the 1163 level would increase the downward pressure and send XAU/USD back to the 1156 (or even 1150) level. Keep in mind that thin market conditions could exacerbate price movements.