By: Stephanie Brown

Swedish based Bitcoin exchange, Safello announced that a new banking partnership will now allow U.K. customers to hold deposits. According to Safello this is a huge opportunity, considering many start-ups in the U.K. have to conduct their Bitcoin banking outside of the country, as British banks do not allow Bitcoin deposits from start-ups due to a fear of money laundering. The company believes that the partnership has come about because of the trust the company built with its banking partners right from the time it came into operation in 2013. Safello additionally feels that Bitcoins and other forms of crypto-currencies are no longer just a fad as there is much more widespread information, which has made not only banking partners but masses adapt the digital currency more easily. The company further supports fast paying methods for users, apart from the deposit services.

Bitcoin has been one of the most volatile financial assets this year, from hitting all-time highs of above $1000 at the end of 2013 to sub $400 levels currently. To say that the digital currency has its own share of ups and downs would be a massive understatement. Many analysts believe that its volatility roller-coaster is the primary reason that many potential investors have shied away.

Currently, market participants believe that the over the past few months the interest in Bitcoin has been waning. Fundamental positives for the digital currency still remain such as lower transaction costs as compared to credit cards, and no regulatory hurdles for cross-border money transfers. However, these two facts so far have not attracted the broader public. Industry experts believe that because Bitcoin is still in its early developmental stage, volatility issues will still linger for some time.

Technical Analysis

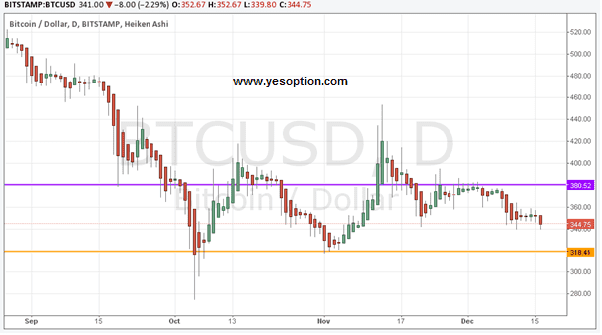

The BTC/USD fell below its $350 psychological level and is now trading lower at $344. As of now it has strong support at the $336 and $328 levels, whereas its resistance stands at $349, $355.

Actionable Insight

Sell the BTC/USD below $342.5 for target of $339, $337, with a stop-loss of $344.