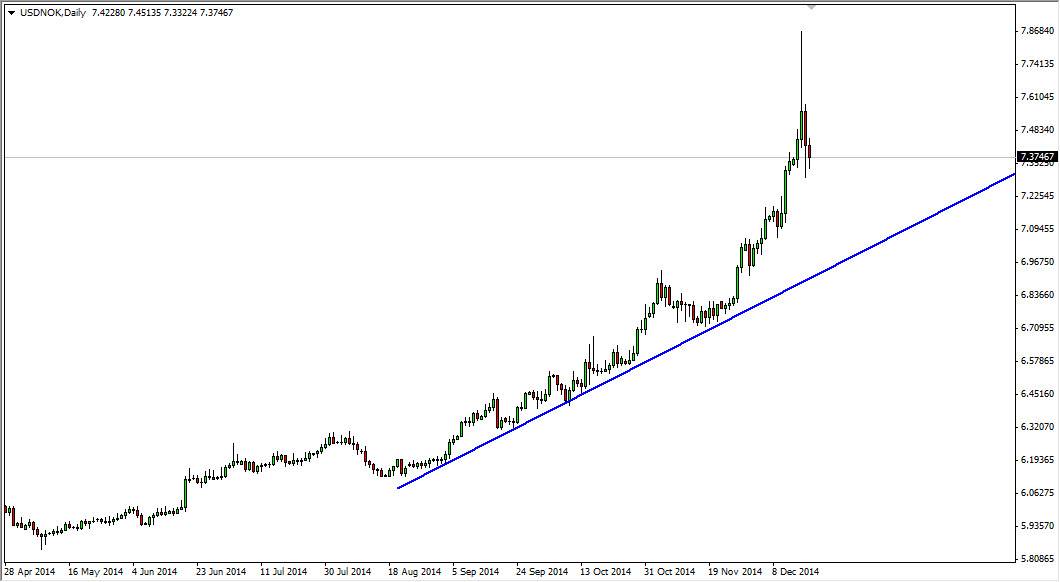

The USD/NOK pair is one that is highly sensitive to the oil markets. That’s because most of the oil rigs in the North Sea are Norwegian. This of course means that the market reacts to the oil market quite drastically, and the fact that the US dollar continues to strengthen overall works against the value of the oil markets, which in turn works against the value of the Norwegian krone. Ultimately, this is a pair that I like trading in reference to the oil market but as you can see there is a trend line on the chart that the market has broken well above. In other words, we are simply overbought and I believe that we need to pull back and find some type of supportive candle in order to start going long again.

I certainly don’t have any interest in buying the Norwegian krone, but recognize that this is a move of that shows real strength overall, and it’s only a matter of time before the buyers return to the marketplace but if you found yourself of the top of this move, you certainly would have taken profits somewhere near the 7.85 level. After all, that would be a massive move.

Ultimately, we should return to the uptrend.

Is not until we break below the trend line that I would even consider shortening this marketplace, and quite frankly that would be a massively bearish move. I’m not saying he can happen, it’s just that it’s not going to happen anytime soon. I think that as we approach the trend line, this should be a nice buying opportunity and as a result I am keep an eye on this market. It’s only a matter of time before people searching profits hand over fist as we enter the end of the year, so although there may not be a trade in this market today, it is one that you need to be paying attention to. With that being said I certainly am.