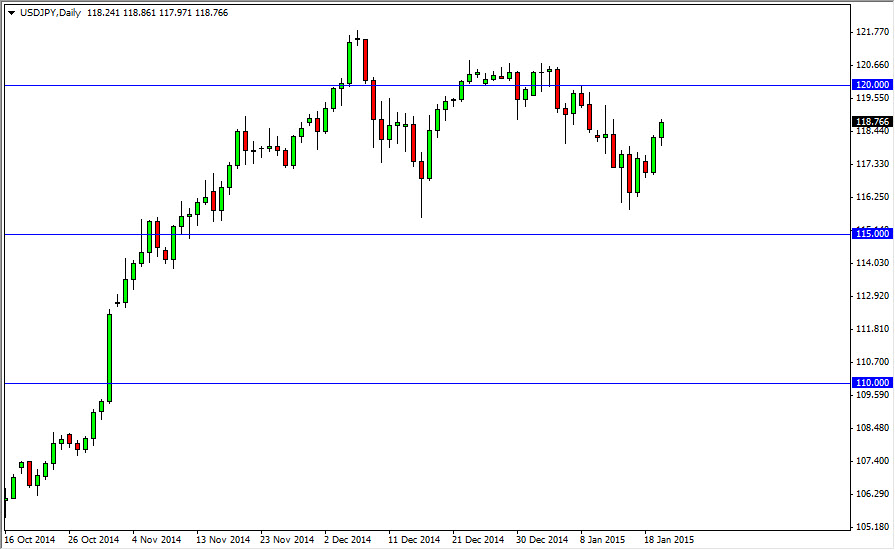

The USD/JPY pair initially dipped slightly during the session on Tuesday, but found enough buyers to continue higher. That being the case, we are testing the 119 level during the session, and it looks as if we could continue to go higher. Ultimately, we think that the market will then target the 120 level, and then possibly even the 122 level. I have no interest in selling this market at all, and I believe that anytime that the market dips, it should offer a buying opportunity offer short-term charts.

On top of that, the 115 level below should continue to be very supportive as this market is most certainly in an uptrend. Because of this, I like supportive candles after short-term pullbacks as value plays, offering significant value in the US dollar which of course is the strongest currency in the Forex markets right now.

Taking a break

I believe that this market is simply taking a break after the massive surge higher, as no trend can run forever in a particular direction. I believe that ultimately this market will continue to grind its way higher, and therefore I have no interest in selling at all. Even if we broke down below the 150 level, there is a cluster that runs all the way down to the 114 level, and then most certainly the 110 level below is massively supportive as well.

It is not until we break down below the 110 level that I would consider the trend changed again, but quite frankly I think with the way that the central banks have been operating, it’s almost impossible to imagine that this pair isn’t going to continue to go in the same direction. With that, this is a “buy only” pair and I believe that it will continue to be for several years as traders out there will more than likely make their careers based upon this particular move. As long as the Bank of Japan continues with its loose monetary policy, ultimately this pair can only go higher as the Federal Reserve has step away from quantitative easing.