Gold prices fell $4.76 an ounce on Tuesday as strength in the dollar and a rise in equities dimmed the precious metal's appeal. Technical outlook remains weak since gold took a hit after strong U.S. jobs data raised expectations that the Federal Reserve might hike rates around mid-year. However, market players keep a wary eye on Europe, where the probability of Greece's exit from the euro zone has risen in recent days as Prime Minister Alexis Tsipras has insisted that his government would not seek an extension to the current bailout.

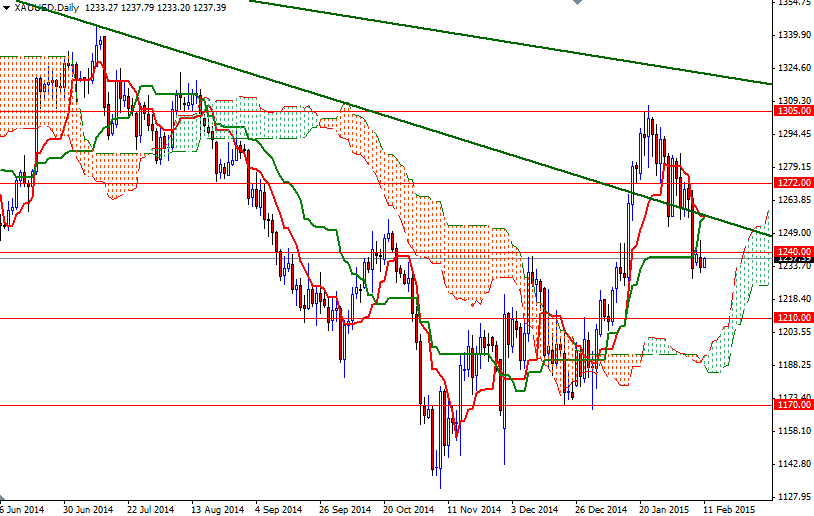

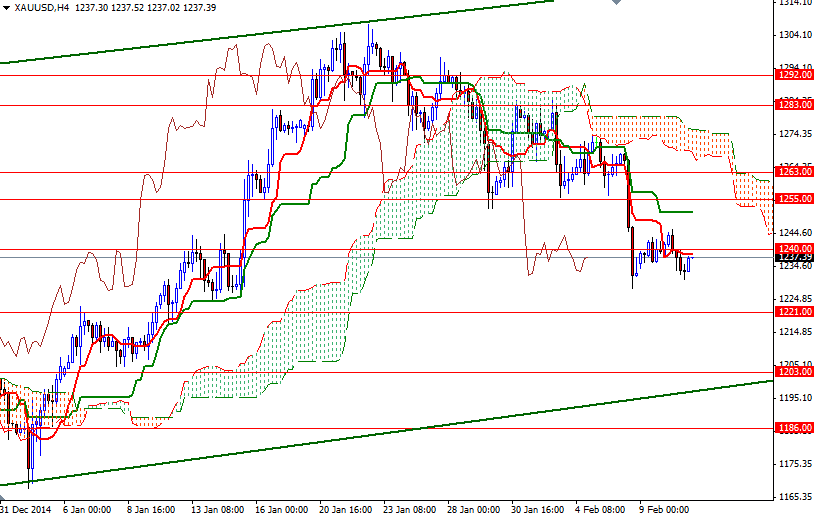

Currently the XAU/USD pair is below the 1240 level but we still remain within the trading range of the previous 3 trading days. The market has found support around the 1230 level though the candles look weak. Trading below the Ichimoku cloud on the 4-hour time maintains a pressure on prices. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines also create a tough situation for the bulls.

If the support around 1230 fails to hold the market, it is likely we will see the XAU/USD pair testing 1225 and 1221/1218. Closing below 1218 level on a daily basis would indicate that 1210 will be the next target. The bulls will need to push and hold prices above the 1240 level, which happens to be the 38.2 retracement of the bullish run from 1131.96 to 1307.47, so that they can gain more traction to approach the critical barrier between the 1255 and 1263. Since some forms of resistance (the shorter term descending trend-line, daily Tenkan-Sen and Kijun-Sen) converge in that area, I believe it will play a crucial role. If the market breaks through, the bulls will be aiming 1273 and 1283 afterwards.