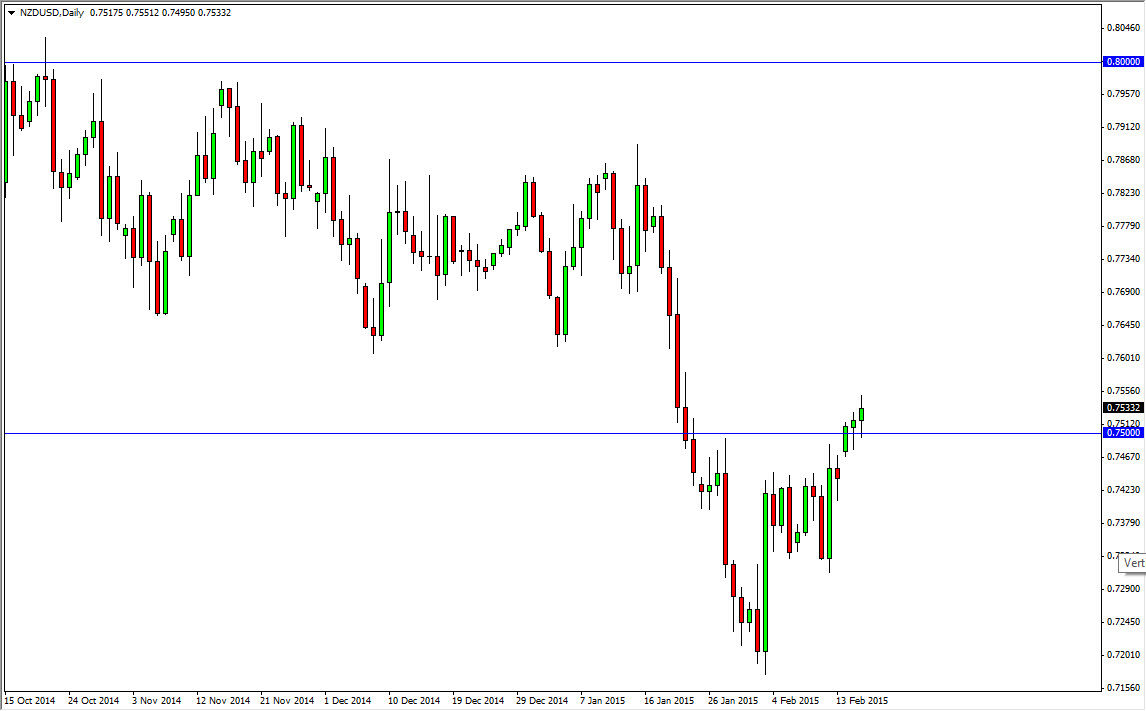

The NZD/USD pair went back and forth during the session on Tuesday, as the 0.75 level proved itself to be supportive enough. However, I still believe that there is a lot of resistance above and that we are simply in the middle of a big “zone”, which of course is a very resistive overall. Ultimately, the market looks as if it could go bit higher but I think that the 0.7650 level is the top of this massive resistance barrier, and is going to take a lot of momentum to break above. With that being the case, I feel that simply waiting for a selling opportunity is probably the best way to approach the New Zealand dollar at this point.

Looking at this chart, I think that waiting for a resistive candle is going to be something that most traders are waiting for, especially considering that we are in such a massive downtrend. After all, the US dollar is by far the favored currency around the world, and the New Zealand dollar of course is so heavily influenced by the commodities market, which of course is a necessarily strong at the moment. In other words, it’s difficult to find a reason to own the Kiwi dollar.

Central bank intervention

Remember that the Royal Bank of New Zealand recently intervened in the Forex markets in order to bring down the value of the Kiwi dollar. They have recently stated openly that they believe that “fair value” in this particular pair is the 0.68 handle, so I think it’s only a matter of time before trader start to worry about whether or not the central bankers in Wellington get antsy and start shorting the Kiwi again.

On top of that, there is a massive cluster just above the 0.7650 level that actually extends all the way to the 0.7850 level, so regardless it’s going to be difficult to buy this market as there is just simply far too much above that could cause problems. On a resistant candle I am more than willing to sell this market, but in the meantime I am being very patient on the sidelines.