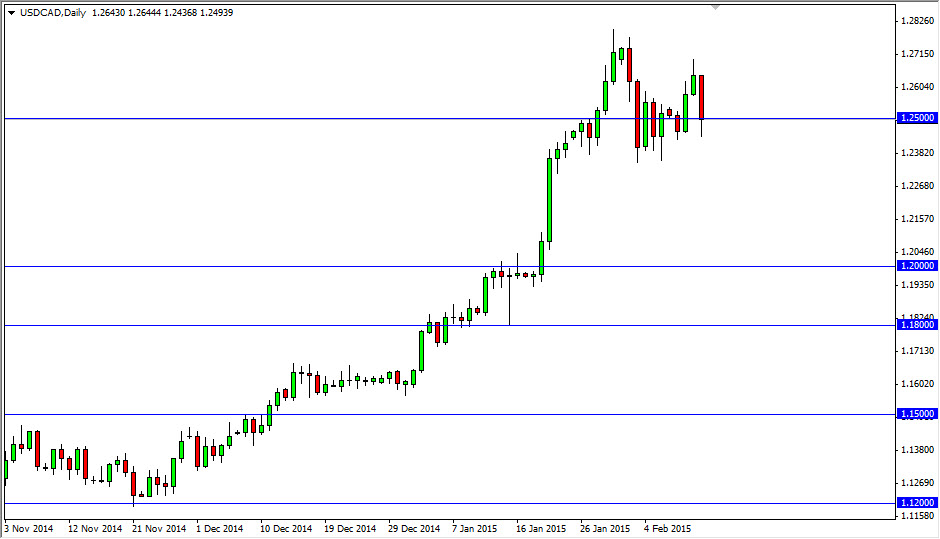

The USD/CAD pair fell during the course of the session on Thursday, crashing through the 1.25 handle. However, you can see that the market did in fact bounce though, and that of course shows that there are buyers below. With that, I feel that the USD/CAD pair is still ready to go higher and every time it pulls back you have to think that the US dollar is essentially “on sale.” Because of this, I am only buying this market as it is most certainly in an uptrend, and I think that there is significant support all the way down to the 1.24 handle.

If we did break below there though, we could see a move all the way down to the 1.20 level but I’m going to ignore selling the market in that general vicinity. This is because it is against the trend and quite frankly this pair can move rather rapidly out of the blue.

Buying on the dips

I believe in buying on the dips when it comes to this pair, as the market is most certainly bullish overall. However, I recognize that there are some certain barriers above that could cause a bit of trouble from time to time. The 1.28 level above is massively resistive, but even more important as the 1.30 handle, as it was the very top of the market during the financial crisis. If we break above the 1.30 level anytime in the future, that would be disastrously bearish for the Canadian dollar, and should push this market much, much higher. Him

As I mentioned before, the 1.20 level below is the massive “floor” in this market place, and as a result I have no interest in selling until we get well below there. So having said that, I believe that with the oil markets being so weak at the moment, there’s really not a whole lot in the way of interest in owning the Canadian dollar anyway. Ultimately, I do think that we are going to test the aforementioned 1.30 handle.