Gold ended the week down by 1% at $1157.66 per ounce as concerns grew over the prospects of rising U.S. interest rates pushed the dollar to multiyear highs and investors’ appetite for the precious metal as an alternative investment. Market participants have been speculating that the Fed might begin the normalization process as early as June since the release of the US jobs report for February. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 81892 contracts, from 115820 a week earlier.

Attention now turns to the U.S. Federal Reserve as a two-day meeting of its policy-setting committee kicks off Tuesday. Although last week's disappointing retail sales data from the US raised some doubts on the timing of the first rate increase, people expect the Federal Open Market Committee to discard the "patient" phrase to have more flexibility. So far the Fed stayed on the safe side to maintain its credibility by using conditional words but ended up being trapped by that language. Understandably, policy makers don't want to cause turbulence in financial markets but they want to move away from strong forward guidance and be data dependent.

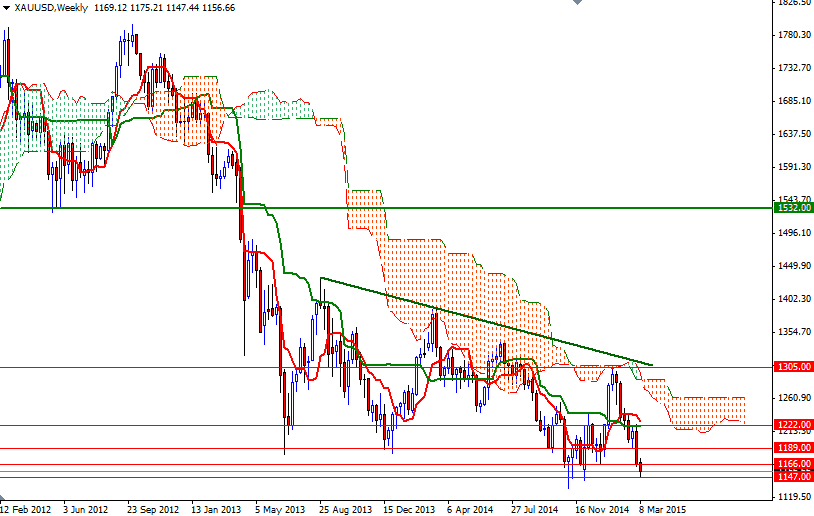

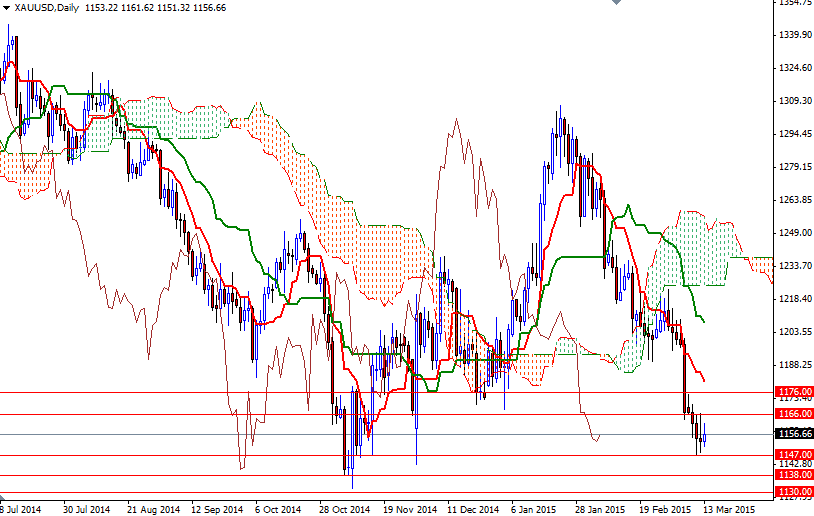

For the last few weeks, I have been repeating that gold will struggle to move higher as higher prices will continue to attract sellers but now the XAU/USD pair stays just above an important support zone which extends to the 1130 level. If the 1147 level fails to hold the market, then it is likely that we will test this area. Breaking through 1130 would open up the risk of a move towards the 1116/4 region. Once below that, there is a strong possibility that the pair will fall to the 1092/85 area before finding some support. On the other hand, if the bulls regain some strength and push prices back above the 1166 level, then XAU/USD is likely to proceed to 1176. Only a close above 1176 would indicate that prices will retrace towards the 1189 level where the top of the Ichimoku cloud on the 4-hour time is located.